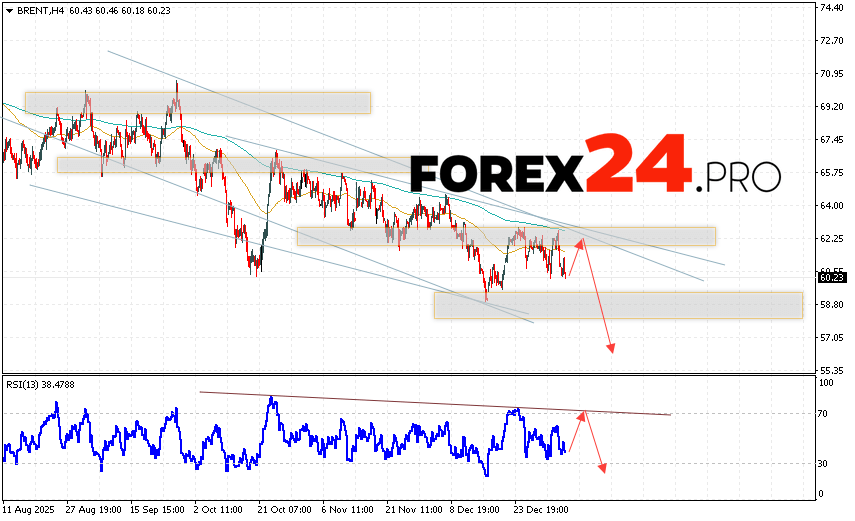

Brent crude oil prices continue to move within a developing correction and descending channel. At the time of this forecast’s publication, the price of Brent crude oil is $60.23 per barrel. Moving averages indicate a short-term bearish trend for oil. Prices are again testing the area between the signal lines, indicating pressure from sellers of “Black Gold” and a potential continuation of the asset’s price decline from current levels. At this point, we should expect an attempt at a bullish correction and a test of the resistance level near $62.05 per barrel. Subsequently, a downward rebound and a continued decline below $56.45 are expected.

Brent crude oil Forecast for January 8, 2026

An additional signal of a decline in Brent crude oil prices will be a rebound from the resistance line on the relative strength indicator (RSI). A second signal will be a rebound from the upper boundary of the bearish channel. A strong rally and a breakout of $65.35 per barrel would cancel the oil price decline scenario. This would indicate a breakout of the resistance area and continued growth in BRENT prices above $72.05. A breakout of the support area and a close of Brent prices below $59.55 would confirm a decline in oil prices and quotes.

Brent crude oil Forecast for January 8, 2026suggests an attempt to test the resistance level near $62.05. Further declines are expected with a target below $56.45. A test of the trend line on the relative strength indicator (RSI) would support a downside scenario. A strong rally and a breakout of $65.35 would cancel the Brent price decline scenario. This would indicate continued growth in prices above $72.05.