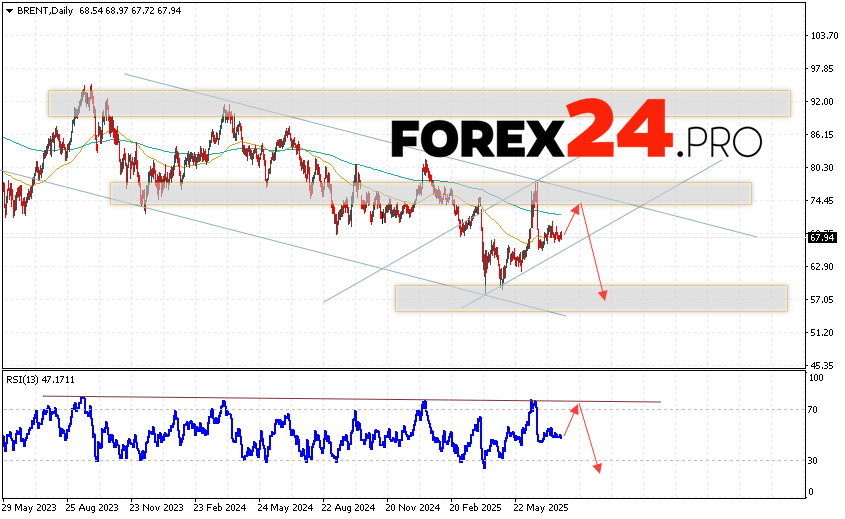

BRENT oil quotes are ending the trading week near the $67.94 per barrel area. Moving averages indicate a bearish trend. Prices are again testing the area with downward signal lines, which indicates pressure from commodity sellers and a potential continuation of the decline from current levels. Now, we should expect an attempt at a bearish correction and a test of the support area near the level of 73.55. Then, we should consider a downward rebound and a continuation of the decline in oil to the area below the level of $57.05 per barrel.

Brent Weekly Forecast July 28 — August 1, 2025

An additional signal in favor of a decline in oil prices this week will be a test of the resistance line on the relative strength indicator. The second signal will be a rebound from the upper border of the bearish channel. A strong rise and a breakout of the 80.65 level will cancel the scenario of a decline in BRENT oil prices during the trading week of July 28-August 1, 2025. This will indicate a breakout of the resistance area and a continuation of oil growth to above the 86.55 level. Confirmation of the decline should be expected with a breakout of the support area and the closing of quotes below the 63.35 level, which will indicate a breakout of the lower border of the bullish correction channel.

Brent Weekly Forecast July 28 — August 1, 2025 suggests an attempt to test the resistance area near the 73.55 level. From there, a rebound and an attempt to continue the decline in oil prices should be expected, with a potential target at 57.05. An additional signal in favor of a decline in oil prices will be a test of the trend line on the relative strength indicator. A strong price increase and a breakout of the 80.65 area will cancel the decline scenario. This will indicate a breakout of the resistance area and a continuation of oil price growth with a target above the 86.55 level.