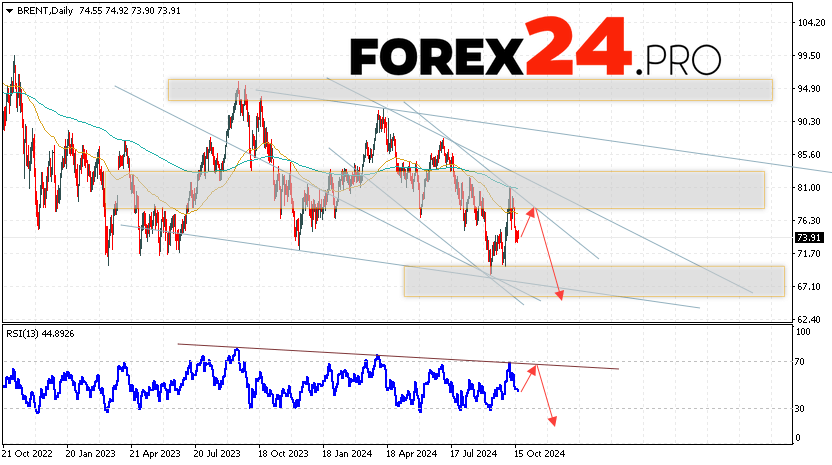

BRENT oil quotes are ending the trading week near the area of 73.91 dollars per barrel. Moving averages indicate the presence of a bearish trend. Prices broke through the area with signal lines downwards, which indicates pressure from sellers of raw materials and a potential continuation of the fall from the current levels. At the moment, we should expect an attempt to develop growth and a test of the resistance area near the level of 76.55. Then, it is worth considering a rebound downwards and a continuation of the fall in oil to the area below the level of 66.75 dollars per barrel.

BRENT Forecast and Analysis October 21 — 25, 2024

An additional signal in favor of a decrease in oil quotes this week will be a test of the resistance line on the relative strength indicator. The second signal will be a rebound from the upper border of the descending channel. The cancellation of the option of falling quotes and prices for BRENT oil in the trading week of October 21 — 25, 2024 will be strong growth and a breakout of the level of 82.75. This will indicate a breakout of the resistance area and a continuation of oil growth to the area above the level of 87.05. With a breakout of the support area and closing of quotes below the level of 70.05.

BRENT Forecast and Analysis October 21 — 25, 2024 suggests an attempt to test the resistance area near the level of 76.55. Where we should expect a rebound and an attempt to continue the fall in oil with a potential target at the level of 66.75. An additional signal in favor of a decrease in oil prices will be a test of the trend line on the relative strength indicator. The cancellation of the fall option will be a strong price growth and a breakout of the 82.75 area. This will indicate a breakout of the resistance area and continued growth in oil prices with a target above the 87.05 level.