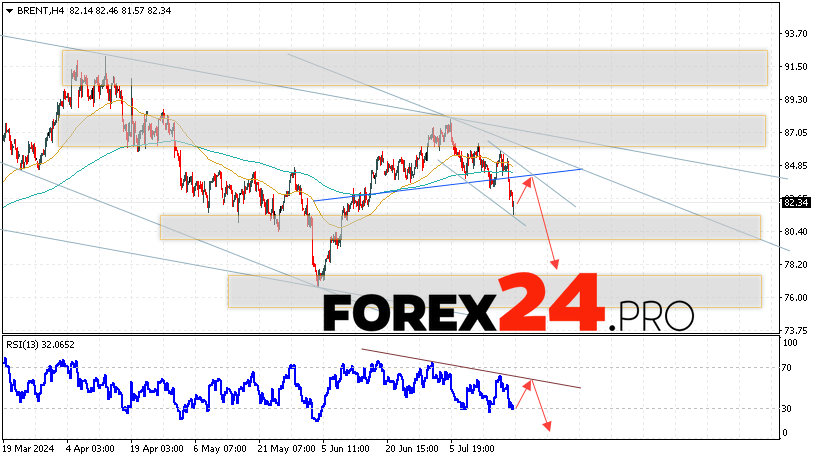

Brent oil quotes continue to move as part of the development of the fall and the beginning of the “Head and Shoulders” model. At the time of publication of the forecast, the price of Brent oil is $82.34 per barrel. Moving averages indicate a short-term bearish trend in oil. Prices have broken through the area between the signal lines downwards, which indicates pressure from sellers of Black Gold and a potential continuation of the fall in the value of the asset from current levels. At the moment, we should expect an attempt to develop growth and test the resistance level near the area of 83.55 dollars per barrel. Next, a rebound downwards and a continuation of the fall in the oil price to the area below the level of 78.20.

Brent Forecast for July 23, 2024

An additional signal in favor of a reduction in quotes and prices for Brent oil will be a test of the resistance line on the relative strength indicator (RSI). The second signal will be a rebound from the lower boundary of the Head and Shoulders reversal pattern. Cancellation of the option of falling oil prices will be a strong increase in quotations and a breakdown of the level of 85.45 dollars per barrel. This will indicate a breakdown of the resistance area and continued growth of BRENT quotes to the area above the level of 90.65. Confirmation of the fall in quotes and oil prices will be a breakdown of the support area and closing of Brent prices below the level of 80.45.

Brent Forecast for July 23, 2024 suggests an attempt to test the resistance level near the 83.55 area. Further, oil continues to fall with a target below the level of 78.20. A test of the trend line on the relative strength index (RSI) will support a decline in the asset. Cancellation of the option for a fall in the price of Brent oil will be a strong growth and a breakdown of the level of 85.45. This will indicate continued growth of quotes to the area above the level of 90.65.