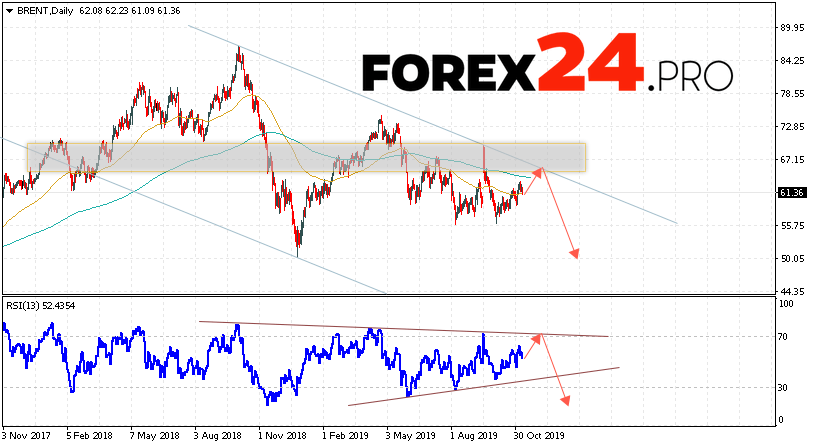

BRENT complete the trading week near the area of 61.36 dollars per barrel. And it continues to move within the correction and the downward channel. Moving averages indicate the presence of a downward trend, prices several times repelled from the signal lines, which indicates pressure from sellers. At the moment, we should expect an attempt to continue the development of the upward correction and test the resistance area near the level of 62.25. Then a rebound and continued fall of oil to the area below the level of 50.05 dollars per barrel.

BRENT oil Forecast and Analysis November 11 — 15, 2019

An additional signal in favor of reducing oil quotes this week will be a test of the resistance line on the relative strength index (RSI). The second signal will be a rebound from the upper boundary of the downward channel. Cancellation of the option of falling quotes and BRENT oil prices in the trading week of November 11 – 15, 2019 will be a strong growth and a breakdown of the level of 68.35. This will indicate a breakdown of the upper boundary of the downward channel and continued growth of oil in the region above the level of 73.95. With the breakdown of the support area and the closing of quotations below 55.55, we should expect confirmation of a decrease in BRENT oil prices.

BRENT oil Forecast and Analysis November 11 — 15, 2019 implies an attempt to test the resistance area near the level of 62.25. Where should we expect a rebound and an attempt to drop oil with a potential target of 50.05. An additional signal in favor of lowering the price of oil will be a test of the trend line on the relative strength index (RSI). Cancellation of the fall option will be a strong growth and a breakdown of the 68.35 area. This will indicate a breakdown of the upper boundary of the downward channel and a continued rise in oil prices with a target above 73.95.