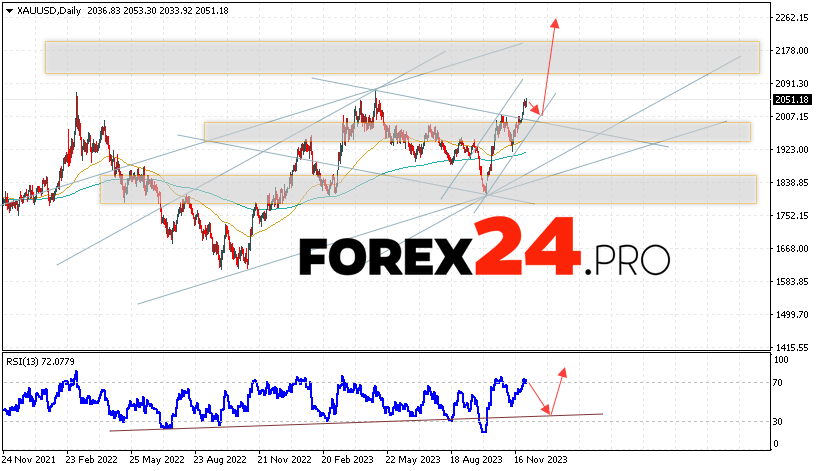

Gold ends the trading week with growth near the 2051 area. XAU/USD quotes continue to move within the framework of growth and have left the correction channel. Moving averages indicate a bullish trend in Gold. Prices have broken through the area between the signal lines upward, which indicates pressure from buyers and a potential continuation of price growth. At the moment, we should expect an attempt to develop a price correction and a test of the support level near the 2005 area. Next, a rebound in prices and continued growth of Gold with a potential target above the level of 2265.

GOLD Forecast December 4 — 8, 2023

An additional signal in favor of an increase in quotations and prices for Gold in the current trading week of December 4 — 8, 2023 will be a rebound from the support line on the relative strength indicator (RSI). The second signal will be a rebound from the upper border of the downward channel. Cancellation of the option to increase XAU/USD quotes will be a fall in price and a breakdown of the 1905 area. This will indicate a breakdown of the support level and a continued fall in Gold prices with a target below the level of 1865. Confirmation of the increase in the value of the asset will be a breakdown of the resistance area and closing of quotes above the level of 2085.

GOLD Forecast December 4 — 8, 2023 assumes an attempt to develop a decline and test the support level near the 2005 area. Then, a continued rise in Gold prices with a target above the level of 2265. A test of the trend line on the relative strength index (RSI) will be in favor of raising quotes. Cancellation of the growth option for Gold will be a fall and a breakdown of the level of 1905. This will indicate a continued decline in quotes to the area below the level of 1865.