On Friday, Gold held above $1950 an ounce after gaining 0.7% in the previous trading session, which was boosted by dollar weakness as the Federal Reserve paused its monetary tightening campaign while other major central banks keep raising interest rates. However, Gold is still close to three-month lows as the Fed hinted at a possible two 0.25% rate hikes this year and the European Central Bank announced a 0.25% rate hike on Thursday and signaled further tightening. The Bank of England also plans to raise rates at its June meeting. At the same time, the People’s Bank of China cut key short-term interest rates for the first time in ten months this week, and the Bank of Japan left its extremely loose monetary policy unchanged on Friday.

GOLD Weekly Forecast June 19 — 23, 2023

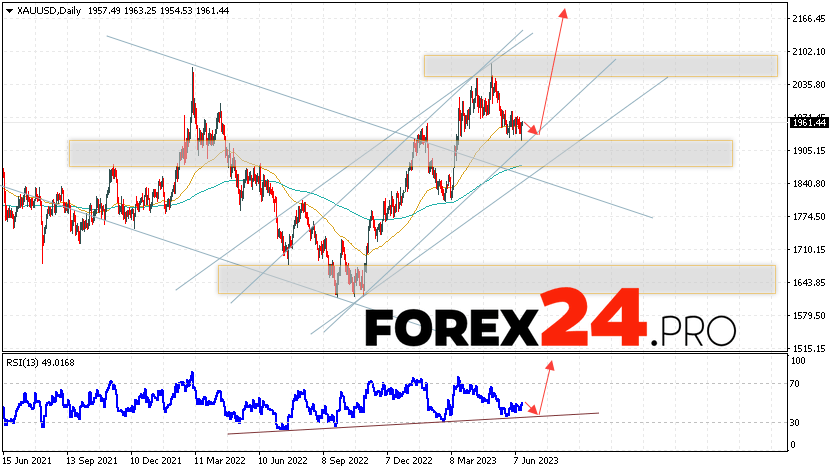

Gold completes the trading week with a correction near the 1961 area. XAU/USD quotes continue to move within a slight increase and a bullish channel. Moving averages indicate the presence of a bullish trend for Gold. Prices have gone up from the area between the signal lines, which indicates pressure from buyers and a potential continuation of price growth. At the moment, we should expect an attempt to develop a decrease in prices and a test of the support level near the 1955 area. Further, a rebound in prices and continued growth of Gold with a potential target above the level of 2165.

An additional signal in favor of the rise in quotes and prices for Gold in the current trading week June 19 — 23, 2023 will be a rebound from the support line on the relative strength index (RSI). The second signal will be a rebound from the lower border of the bullish channel. Cancellation of the growth option for XAU/USD quotes will be a fall in prices and a breakdown of the 1905 area. This will indicate a breakdown of the support level and a continued fall in Gold prices with a target below the level of 1865. A confirmation of the growth in the value of the asset will be a breakdown of the resistance area and closing of quotes above the level of 2015.

GOLD Weekly Forecast June 19 — 23, 2023 suggests an attempt to develop a decline and test the support level near the area of 1955. Then, the continued growth in Gold prices with a target above the level of 2165. A test of the trend line on the relative strength index (RSI) will come out in favor of the rise in quotes. Cancellation of the growth option for GOLD will be a fall and a breakdown of the level of 1905. This will indicate a continued decline in quotes to the area below the level of 1865.

Looking for the Best Forex Broker? We trade at RoboForex. You can receive a rebates from each trade when registering using our partner link

Good site de prédictions, je voudrais des informations sur les signal et les analyses chaque jour. Merci, veuillez accepter mes agrément. Merci