Last week, gold prices slightly increased, reaching $1,873 per ounce. The rise was driven by the release of the US Consumer Expenditures and Prices (PCE) report, which indicated moderation in inflation pressures. The core PCE price index, the Federal Reserve’s preferred measure of inflation, came in at 3.9% in August, the weakest since September 2021, in line with market expectations. The overall inflation rate also corresponds to forecasts and amounted to 3.5%.

Personal income and expenses continue to grow at a stable pace and are in line with the expectations of economic analysts. However, despite these indicators, gold prices remain close to their lowest levels since March 10. This is due to pressure from a strengthening dollar and rising Treasury yields. The market expects the US Federal Reserve to continue its tight monetary policy in the near future, which could impact gold price movements.

GOLD Weekly Forecast October 2 — 6, 2023

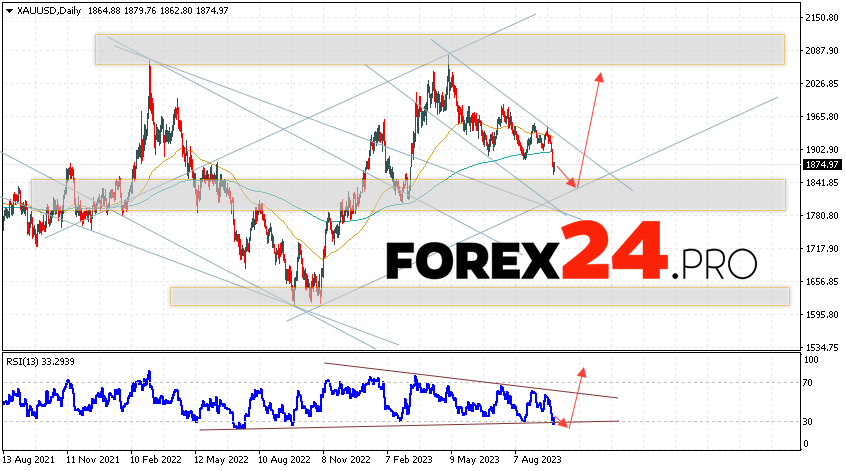

Gold ends the trading week with growth near the 1874 area. XAU/USD quotes continue to move within the framework of a strong fall and a bullish channel. Moving averages indicate a bullish trend in Gold. Prices are again testing the area between the signal lines, which indicates pressure from sellers and a potential continuation of the price fall. At the moment, we should expect an attempt to develop a decline in prices and a test of the support level near the 1835 area. Next, a rebound in prices and continued growth of Gold with a potential target above the level of 2035.

An additional signal in favor of an increase in quotations and prices for Gold in the current trading week of October 2 — 6, 2023 will be a rebound from the support line on the relative strength indicator (RSI). The second signal will be a rebound from the lower border of the bullish channel. Cancellation of the growth option for XAU/USD quotes will be a fall in price and a breakdown of the 1820 area. This will indicate a breakdown of the support level and a continued fall in Gold prices with a target below the level of 1775. Confirmation of the growth in the value of the asset will be a breakdown of the resistance area and closing quotes above the 1965 level, which will indicate on the breakdown of the upper boundary of the descending correction channel.

GOLD Weekly Forecast October 2 — 6, 2023 assumes an attempt to develop a decline and test the support level near the 1835 area. Then, a continued rise in Gold prices with a target above the level of 2035. A test of the trend line on the relative strength index (RSI) will be in favor of raising quotes. Cancellation of the growth option for Gold will be a fall and a breakdown of the level of 1820. This will indicate a continued decline in quotes to the area below the level of 1775.