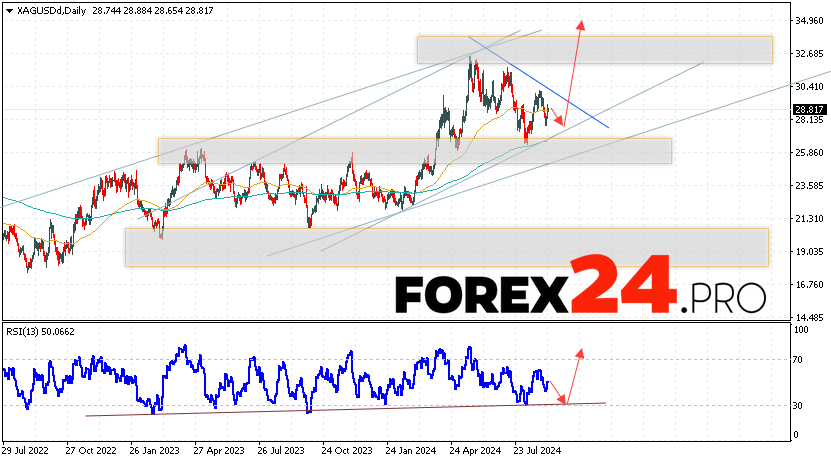

Quotes of Silver XAG/USD end the trading week near the 28.81 area. Quotes continue to move within the development of growth and a bullish channel. Moving averages indicate a bullish trend for the asset. Prices have broken through the area between the signal lines upwards, which indicates pressure from metal buyers and potential continuation of growth from current levels. At the moment, we should expect an attempt to develop a bearish correction in the asset value and a test of the support level near the 28.05 area. Further, the continuation of the growth of the Silver price with a potential target above the 34.95 level.

Silver Forecast and Analysis September 9 — 13, 2024

A rebound from the support line on the relative strength indicator will act in favor of the growth of quotes and prices for Silver in the current trading week of September 9 — 13, 2024. The second signal will be a rebound from the lower border of the bullish channel. The cancellation of the growth option for XAG/USD quotes will be a fall and a breakout of the 25.45 area. This will indicate a breakout of the support area and a continuation of the fall in Silver prices with a target below 21.75. The development of growth will be confirmed by a breakout of the resistance level and closing of prices above 30.85, which will indicate a breakout of the upper border of the “Head and Shoulders” reversal pattern and the beginning of working out with targets above.

Silver Forecast and Analysis September 9 — 13, 2024 suggests an attempt to test the support level near the 28.05 area. Then, the continuation of the growth of Silver prices with a target above 34.95. The test of the trend line on the relative strength indicator will be in favor of growth. The cancellation of the XAG/USD growth option will be a fall and a breakout of the 25.45 level. This will indicate a continuation of the decline in quotes to the area below 21.75.