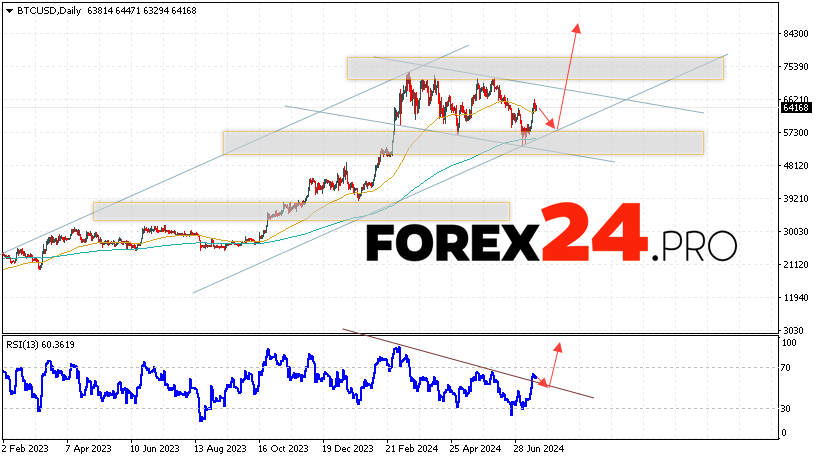

Bitcoin BTC/USD ends the trading week at 64168 and continues to move within the development of growth and a bullish channel. Moving averages indicate a bullish trend. Prices are testing the area between the signal lines, which indicates pressure from buyers of the asset and a potential continued growth in the asset’s quotes. At the moment, we can expect an attempt to develop a bearish correction in the price of the coin and a test of the support area near the level of 57305. From where we can again expect a rebound upward and continued growth of the Bitcoin rate with a potential target above the level of 84305.

Bitcoin Forecast and Analysis July 22 — 26, 2024

An additional signal in favor of growth in BTC/USD quotes in the current trading week of July 22 — 26, 2024 will be a rebound from the lower boundary of the bullish channel. The second signal will be a rebound from the support line on the relative strength indicator (RSI). Cancellation of the Bitcoin fall option will be a fall and a breakdown of the area of 47605. This will indicate a breakdown of the support area and a continued fall in BTC/USD quotes with a potential target below the level of 42505. Confirmation of the development of a bullish movement will be a breakdown of the support area and closing of quotes above the level of 68045, which will indicate a breakdown the upper boundary of the downward correction channel.

Bitcoin Forecast and Analysis July 22 — 26, 2024 assumes an attempt at the support area near the level of 57305. Then, the continued growth of the cryptocurrency to the area above the level of 84305. An additional signal in favor of an increase in the Bitcoin rate in the current trading week will be a test of the trend line on the relative strength index (RSI). . Cancellation of the option to increase Bitcoin cryptocurrency quotes will be a fall and a breakdown of the area of 47605. In this case, we should expect a continuation of the decline with a target at the level of 42505.

Looking for the Best Forex Broker? We trade at RoboForex. You can receive a rebates from each trade when registering using our partner link