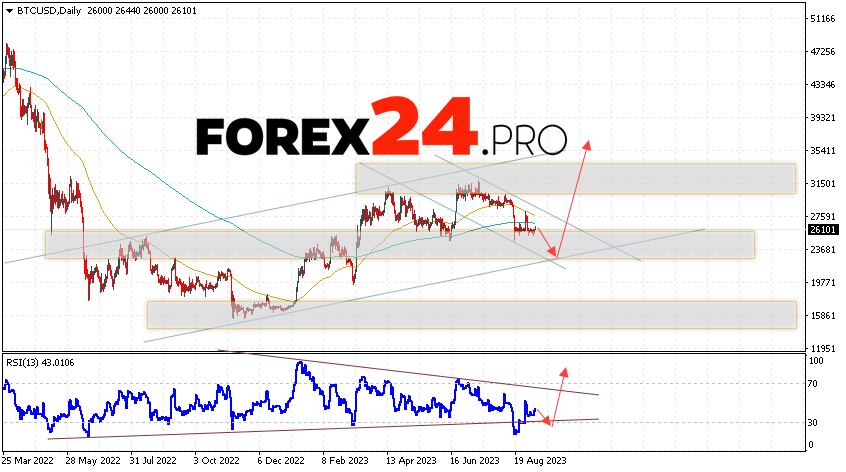

Bitcoin BTC/USD ends the trading week at the level of 26101, continuing to move as part of the development of the correction and bullish channel. Moving averages indicate a bullish trend. Prices have broken through the area between the signal lines downwards, which indicates pressure from sellers of the asset and a potential continuation of the fall in the asset’s quotes. At the moment, we can expect an attempt to develop a decline in the price of the coin and a test of the support area near the level of 23405. From where we can again expect a rebound upward and continued growth of the Bitcoin rate with a potential target above the level of 35405.

Bitcoin Weekly Forecast September 11 — 15, 2023

An additional signal in favor of an increase in BTC/USD quotes in the current trading week of September 11 — 15, 2023 will be a rebound from the lower boundary of the bullish channel. The second signal will be a rebound from the support line on the relative strength indicator (RSI). Cancellation of the Bitcoin growth option will be a fall and a breakdown of the 22225 area. This will indicate a breakdown of the support area and a continued fall in BTC/USD quotes with a potential target below the level of 18405. Confirmation of the development of a bullish movement will be a breakdown of the resistance area and closing of quotes above the level of 28305, which will indicate a breakdown the upper boundary of the downward correction channel.

Bitcoin Weekly Forecast September 11 — 15, 2023 assumes an attempt at the support area near the level of 23405. Then the cryptocurrency will continue to grow to the area above the level of 35405. An additional signal in favor of an increase in the Bitcoin rate in the current trading week will be a test of the trend line on the relative strength index (RSI). Cancellation of the option to increase Bitcoin cryptocurrency quotes will be a fall and a breakdown of the area of 22225. In this case, we should expect a continuation of the decline with a target at the level of 18405.