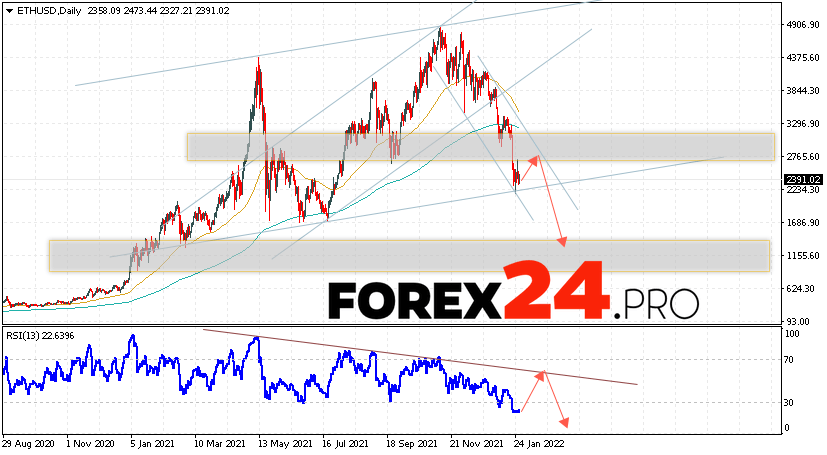

Ethereum ETH/USD ends the trading week at 2391 and continues to move within the fall and the bullish channel until there was a breakdown of the lower border. Moving averages indicate the presence of a bullish trend for ETH/USD. However, prices have broken through the area between the signal lines down, which indicates pressure from cryptocurrency sellers and a potential continuation of the fall from current levels. At the moment, we should expect an attempt to develop a price increase and test the resistance level near the area of 2765. Where can we expect a rebound again and a continued fall in the exchange rate and the cost of Ethereum with a potential target below the level of 1355.

Ethereum Weekly Forecast January 31 — February 4, 2022

An additional signal in favor of falling ETH/USD quotes in the current trading week January 31 — February 4, 2022 will be a test of the downtrend line on the relative strength index (RSI). The second signal will be a rebound from the upper border of the descending channel. Cancellation of the option of falling cryptocurrency prices in the current trading week will be a strong growth and a breakdown of the level of 3305. This will indicate a breakdown of the resistance area and a continued rise in ETH/USD quotes with a potential target above the level of 4855. Confirmation of the fall of the Ethereum cryptocurrency will be a breakdown of the support area and closing of quotes below the level 2165, this is a strong support for buyers of the asset, as well as a breakdown of the lower limit of the bullish channel.

Ethereum Weekly Forecast January 31 — February 4, 2022 suggests an attempt to decrease and test the resistance area near the level of 2765. Where should we expect a rebound and the cryptocurrency will continue to fall to the area below the level of 1355. An additional signal in favor of Ethereum’s depreciation will be a test of the trend line at relative strength indicator. Cancellation of the fall option will be a strong growth and a breakdown of the area of 3305. In this case, we should expect a continuation of the rise with a target above the area of 4855.