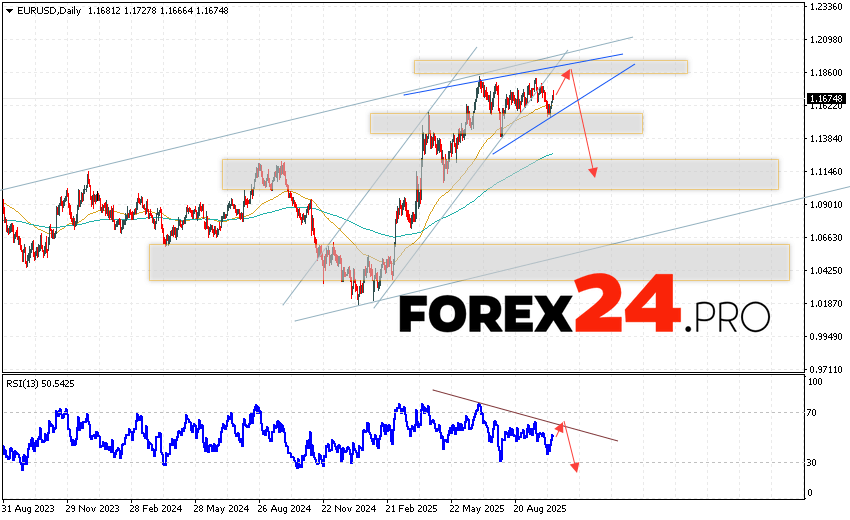

The Euro Dollar EUR/USD currency pair is ending the trading week with a bullish correction near 1.1674. Moving averages indicate a bullish trend for the pair. Prices have broken above the signal lines, indicating upward pressure from buyers of the European currency and a likely continuation of growth from current levels. As part of the Euro exchange rate forecast for the trading week, we expect an attempt to further increase the EUR/USD pair and a test of the resistance area near 1.1825. From here, a downward rebound and continued decline in the Euro Dollar currency pair are expected this trading week. A potential upside target is below 1.1135.

EUR/USD Weekly Forecast October 20 — 24, 2025

An additional signal favoring a decline in the EUR/USD pair on Forex will be a test of the resistance line on the relative strength indicator (RSI). The second signal will be a rebound from the upper boundary of the Wedge reversal pattern. A strong rally and a breakout of 1.2075 will cancel the downward trend in the EUR/USD pair during the current trading week (October 20-24, 2025). This will indicate a breakout of the resistance area and continued growth above 1.2465. A breakout of the support area and a close below 1.1415 should confirm the pair’s decline, indicating a breakout of the lower boundary of the Wedge reversal pattern and the beginning of the pattern’s implementation with targets below.

EUR/USD Weekly Forecast October 20 — 24, 2025 suggests an attempt to develop a bullish correction and a test of the resistance area near 1.1825. From where should we expect a price rebound and a continued decline in the Forex pair below 1.1135? A test of the resistance line on the relative strength indicator (RSI) would be an additional signal of decline. A strong rally and a breakout of 1.2075 would cancel out the EUR/USD decline. In this case, we should expect continued upside with a potential target at 1.2465.