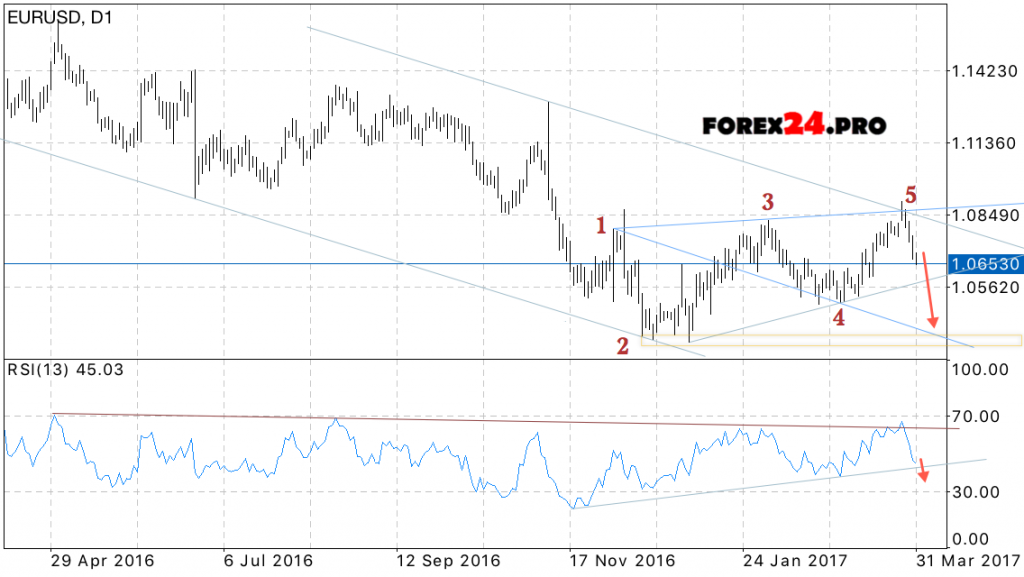

The currency pair Euro Dollar EUR/USD has completed the trading week at the level of 1.0653. The pair was able to show a strong fall from the resistance area of 1.0850. At the moment, the potential for continuing the fall of quotations of the euro dollar to the area below the level of 1.04 remains within the framework of working off the descending wave model of Wolf.

EUR/USD Prediction on April 3, 2017 — April 7, 2017

Canceling the fall of the pair will be a breakdown of the upper limit of the model and the closing of quotes above the level of 1.0950, which indicates the exit of the pair beyond the upper boundary of the descending channel. Expect the acceleration of the fall is with the breakdown of the upward trend line on the price chart, which indicates the breakdown of support for the bearish wave model of Wolf and points to the area for sales of the euro-dollar pair. Also, do not exclude the attempt to test the local minimum area near the level of 1.0350 in the current trading week. In the case of a support line test on the relative indicator and the beginning of the euro growth, consider this upward movement as an upward correction.

Among the important news on the next trading week that may have an impact on the EUR USD rate is worth highlighting, the ISM Production Index April 3, 2017, The change in the number of employees from ADP, the Composite Index ISM for the non-manufacturing sphere, The publication of the FRS protocol April 5, 2017, ECB President Mario Draghi, The number of initial applications for unemployment benefits April 6, 2017, the unemployment rate in the US, as well as NONFARM PAYROLLS April 7, 2017.

EUR/USD Prediction on April 3, 2017 — April 7, 2017 involves an attempt to continue falling to the area below the level of 1.04 as part of the development of the descending Woolf wave model, the elimination of the variant will be the breakdown of the area 1.0950, which will indicate the way out of the upper boundary of the downward channel.