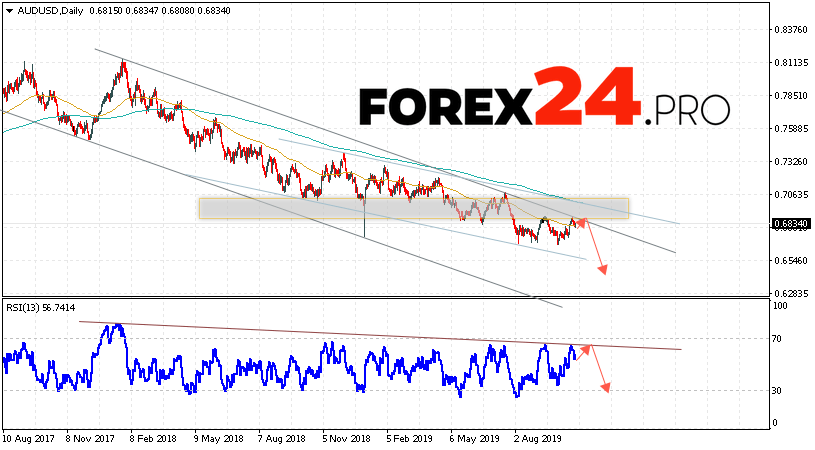

Currency pair Australian Dollar to US Dollar AUD/USD completes the trading week near the area of 0.6834. The pair continues to move within the bullish correction and the downward channel. Moving averages indicate the presence of a bearish trend, prices have several times repelled from these lines. At the moment, we should expect an attempt to continue the development of growth and test the resistance area near the level of 0.6855. Then, the continuation of the fall of AUD/USD with a potential target below the level of 0.6465.

AUD/USD Forecast and Analysis October 28 — November 1, 2019

In favor of the fall of the pair on Forex, a test of the downward trend line on the relative strength index (RSI) will come out. The second signal will be a rebound rebound from the upper boundary of the downward channel. Cancellation of the option to reduce AUD/USD in the current trading week October 28 — November 1, 2019 will be a strong growth and the breakdown level of 0.7085. This will indicate a breakdown of the upper boundary of the channel and continued growth of the Australian Dollar at Forex. The development of the downward trend will be confirmed by the breakdown of the support area and closing below the level of 0.6625. This will indicate an acceleration in the fall of the currency pair.

Among the important news from Australia that may have an impact on the Australian course, it is worth highlighting: Reserve Bank of Australia (RBA) Governor Lowe Speech.

AUD/USD Forecast and Analysis October 28 — November 1, 2019 suggests an attempt to test the level of 0.6855. Further, the continuation of the fall below the level of 0.6465. A test of the trend line on the relative strength index (RSI) will be in favor of reducing the pair. Cancellation of the fall option will be a strong growth and a breakdown of the 0.7085 area. This will indicate a breakdown of the resistance area and continued growth of the pair with a target above 0.7405.