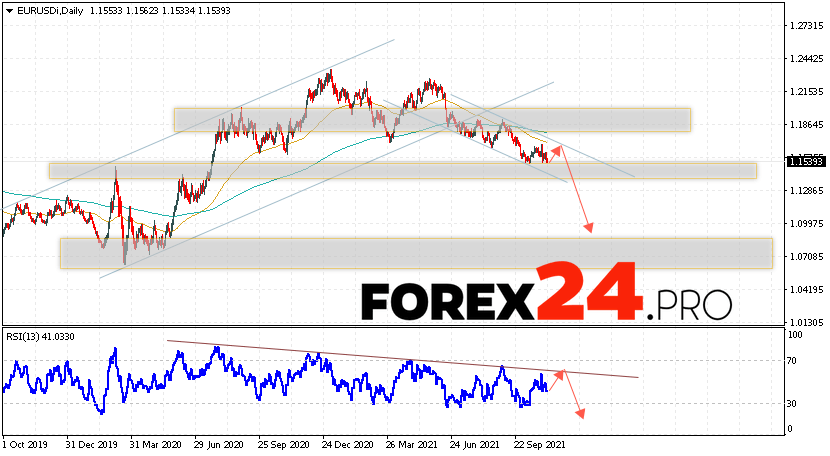

Currency pair Euro Dollar EUR/USD completes the trading week near the 1.1539 area. The pair continues to move as part of the fall and the beginning of the development of the large “Head and Shoulders” reversal pattern. Moving averages indicate a bearish trend. Prices went down from the area between the signal lines, which indicates pressure from the sellers of the European currency and the likely continuation of the fall from the current levels. At the moment, we should expect an attempt to develop a bullish correction and a test of the resistance area near the level of 1.1675. Where the rebound is expected from and the continuation of the fall of the Euro Dollar. A potential target of the decline is the area below the level of 1.0855.

EUR/USD Forecast and Analysis November 8 — 12, 2021

An additional signal in favor of the fall of the EUR/USD currency pair on Forex will be a test of the downward trend line on the relative strength index (RSI). The second signal will be a rebound from the upper border of the descending channel. Cancellation of the option to reduce the quotations of the Euro/Dollar pair in the current trading week November 8 — 12, 2021 will be a strong growth and a breakdown of the level of 1.1875. This will indicate a breakdown of the resistance area and continued growth of the pair to the area above the level of 1.2425. With the breakdown of the support area and closing of quotations below the level of 1.1275, we should expect confirmation of a decline. This will also indicate a breakdown of the lower border of the descending channel, and this is a signal to accelerate the downward movement.

Among the important news from America and Europe in the next trading week that may have an impact on the EUR/USD rate, it is worth highlighting: the ZEW Germany Economic Sentiment Indicator, Federal Reserve System (Fed) Chair Powell Speech, EIA United States Crude Oil Stocks Change, United States JOLTS Job Openings.

EUR/USD Forecast and Analysis November 8 — 12, 2021 suggests an attempt to develop a bullish correction and test the resistance area near the level of 1.1675. Where can we expect the pair to continue falling to the area below the level of 1.0855. An additional signal in favor of a decline will be a test of the resistance line on the relative strength index (RSI). Cancellation of the option to drop the Euro/Dollar will be a strong growth and a breakdown of the level of 1.1875. In this case, we should expect the pair to continue to rise with a potential target at the level of 1.2425.