The American currency showed a decline on Wednesday, July 4, 2024, influenced by disappointing economic data from the United States. A weak services report and ADP jobs report, signaling a slowdown in economic growth, weighed on the dollar versus the euro. Initial jobless claims data, which showed rising unemployment, also contributed to the dollar’s decline. Currency strategists at Rabobank said the data reinforces expectations that the labor market is weakening, which could force the Fed to cut rates this year. Participants are already pricing in two interest rate cuts by the Federal Reserve in 2024. The first reduction of 25 basis points is expected to occur in September; markets estimate the probability of this event at 65%, a week earlier it was 55%. The upcoming non-farm payrolls report for June in the US (Nonfarm Payrolls) may have an impact on the further upward movement of the EURUSD pair. Reuters analysts forecast jobs would rise by 190,000 in June, down from May’s 272,000.

EUR/USD forecast Euro Dollar for July 5, 2024

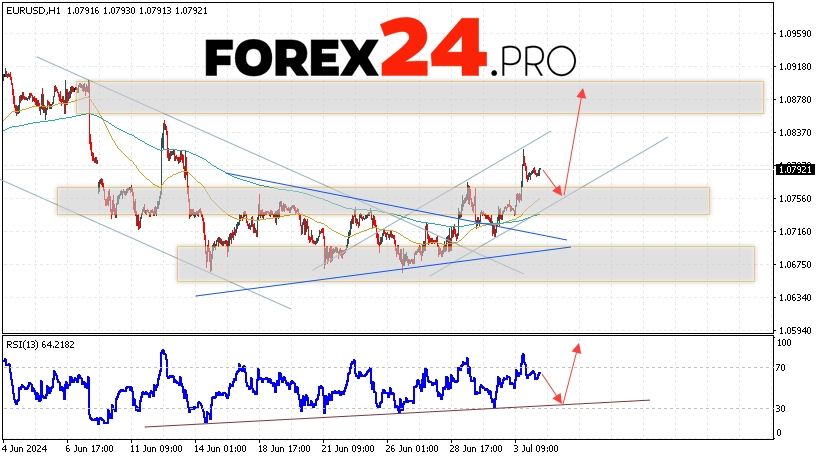

The Euro/Dollar currency pair EUR/USD continues to move as part of the development of growth and development of the “Triangle” pattern. Moving averages indicate a short-term bullish trend for the pair. Prices have broken through the area between the signal signals upward, which indicates pressure from buyers of the European currency and a potential continuation of growth in quotes of the asset pair from current levels. At the time of publication of the forecast, the Euro to Dollar exchange rate for today is 1.0791. As part of the Forex forecast for July 5, 2024, we should expect an attempt to develop a slight price drop and a test of the support level, which is located on the EUR/USD pair near the 1.0755 area. Further, prices will rebound upward and continue to grow in the Euro/Dollar currency pair. The potential target of such a movement on FOREX is the area above the level of 1.0935.

An additional signal in favor of the development of a bullish scenario on the EUR/USD currency pair tomorrow will be a rebound from the lower boundary of the bullish channel. The second signal in favor of this option will be a rebound from the support line on the relative strength indicator (RSI). It is worth noting that the previous test of this line provoked a breakdown of the upper border of the “Triangle” model. Cancellation of the option to increase the quotes of the Euro/Dollar currency pair tomorrow will be a fall and a breakdown of the level of 1.0665. This will indicate a breakdown of the support area and a continuation of the fall to the area at 1.0445. Expect confirmation of growth in the EUR/USD currency pair with a breakdown of the resistance level and closing of the price above the level of 1.0835.

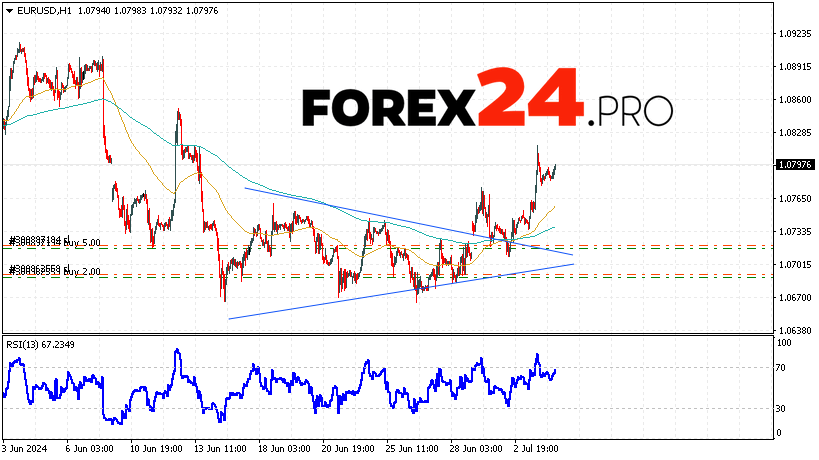

EUR/USD forecast Euro Dollar for July 5, 2024 suggests an attempt to develop a decline in the pair and test the support area near the level of 1.0755. Where should we consider a rebound in the price of the Euro/Dollar pair upward and an attempt to continue the growth of the asset in the market to the area below the level of 1.0935. An additional signal in favor of a rise in the instrument on the Forex market will be a test of the trend line on the relative strength indicator (RSI). Cancellation of the growth option for the EUR/USD pair will be a fall in quotes and a breakdown of the level of 1.0665. This will indicate a breakdown of the support area and a continuation of the fall of the currency pair on Forex to the area below the level of 1.0445.