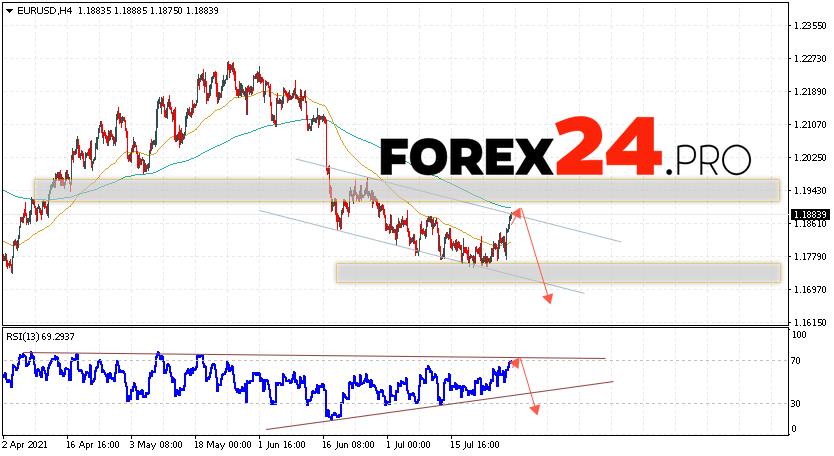

Currency pair Euro/Dollar EUR/USD continues to move as part of the bullish correction and the downward channel. Moving averages indicate a short-term bearish trend for the pair. Prices are again testing the area between the signal lines, which indicates pressure from the sellers of the European currency and a potential continuation of the fall in quotations from the current levels. At the time of the publication of the forecast, the Euro/US Dollar rate is 1.1883. As part of the Forex forecast for July 30, 2021, we should expect an attempt to develop a slight bullish correction and a test of the resistance level, which is located on the pair near the 1.1895 area. Further, a rebound down and the continuation of the fall of the Euro/Dollar currency pair. The potential target of such a movement on FOREX is the area below the level of 1.1675.

EUR/USD Forecast Euro Dollar July 30, 2021

An additional signal in favor of falling EUR/USD quotes will be a rebound from the upper border of the descending channel. The second signal will be a rebound from the resistance line on the relative strength index (RSI). Cancellation of the option of falling quotations of the Euro/Dollar currency pair will be a strong growth and a breakdown of the level of 1.1925. This will indicate a breakdown of the upper bearish channel and a continued rise to the area at 1.2275. It is worth waiting for confirmation of a fall in the EUR/USD currency pair with the breakdown of the support level and closing prices below 1.1725, the bears have not yet been able to take this area.

Among the important news from Europe and the United States, which may have an impact on the EUR/USD pair, it is worth highlighting: Germany Gross Domestic Product (GDP) q/q, European Union Gross Domestic Product (GDP) q/q, European Central Bank (ECB) President Lagarde Speech.

EUR/USD Forecast Euro Dollar July 30, 2021 assumes the development of a correction and a test of the resistance area near the level of 1.1895. Where can we expect a rebound and an attempt to continue the pair’s fall to the area below the level of 1.1675. A test of the trend line on the relative strength index (RSI) will be in favor of the fall of the currency pair. Cancellation of the option to reduce the EUR/USD pair will be a strong growth in quotations and a breakdown of the level of 1.1925. This will indicate a breakdown of the resistance area and a continuation of the rise of the currency pair on Forex to the area above the level of 1.2275.