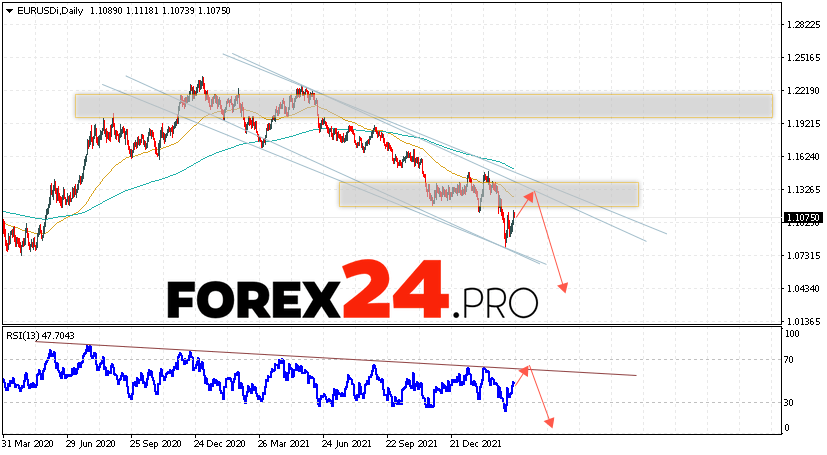

Currency pair Euro Dollar EUR/USD completes the trading week near the region 1.1075 and continue to move as part of the correction and downstream channel. The moving averages indicate the presence of bearish trends. Prices went down from the area between the signal lines, which indicates pressure from the sellers of European currency and the likely continuation of the fall is already with current levels. At the moment, it is worth an attempt to develop the correction and test of the resistance area near the level 1.1295. From where the rebound is expected and the continuation of the fall of the euro dollar. The potential goal of the decline is the area below level 1.0435.

EUR/USD Weekly Forecast March 21 — 25, 2022

An additional signal in favor of the EUR/USD currency pair on Forex will perform a descending trend line on the relative force indicator (RSI). The second signal will be a rebound from the upper border of the downstream channel. The abolition of the decline in the quotations of the Euro/Dollar on the current trade March 21 — 25, 2022 will become strong growth and breakdown of level 1.1525. This will indicate a breakdown of the resistance area and the continuation of the growth of the pair in the region above level 1.1935. With a breakdown of the support area and closure of quotations below level 1.0885, it is worth expecting confirmation of a decline in a pair.

Among the important news from America and Europe at the next trade week, which can have an impact on the EUR/USD course, it is worth highlighting: United States New Home Sales, EIA United States Crude Oil Stocks Change, United States Core Durable Goods Orders m/m, Ifo Germany Business Climate, United States Pending Home Sales m/m.

EUR/USD Weekly Forecast March 21 — 25, 2022 suggests an attempt to develop bovine correction and the test area of resistance near the level 1.1295. Where to expect to continue the fall of the pair to the area below level 1.0435. An additional signal in favor of the reduction will be the test line of the resistance on the relative force indicator. The abolition of the drop in the euro dollar will become strong growth and breakdown of level 1.1525. In this case, it is worth expecting to continue the lifting a pair with a potential target at the level of 1.1935.