The British pound slipped to $1.26 at the end of June, after hitting a 14-month high of $1.2848 on June 16, triggered by investor fears of a possible recession after the Bank of England’s aggressive tightening in recent months. The head of the Bank of England, Andrew Bailey, said that the recent hike in interest rates reflects the resilience of the economy and unexpectedly stable inflation, which supports maintaining a tough stance. In June, British policymakers raised rates by 50 basis points more than expected and expressed readiness for further tightening after data showed persistently high inflation in May. Investors currently expect the prime interest rate to peak at 6.1% by February 2024.

GBP/USD Weekly Forecast July 3 — 7, 2023

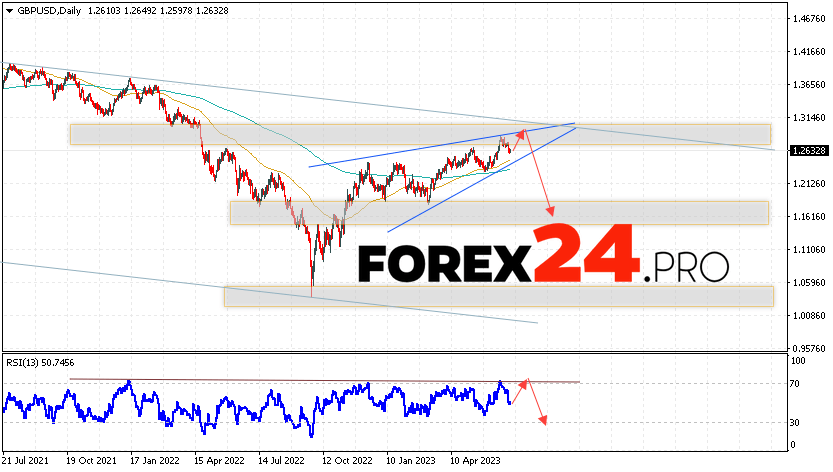

The currency pair Pound/Dollar GBP/USD completes the trading week as part of the development of the correction and the continuation of the formation of the reversal pattern “Wedge” with the aim of working out at the level of 1.1705. Moving averages indicate a bullish trend. Prices have broken through the area between the signal lines up, which indicates pressure from buyers and a potential continuation of the growth of the British Pound against the US Dollar already from current levels. At this point, we should expect an attempt to develop a rise and test the resistance area near the level of 1.2945. Further, a rebound down and the continuation of the fall of the Pound/Dollar quotes to the area below the level of 1.1615.

An additional signal in favor of the decline of the British Pound will be a test of the resistance line on the relative strength index (RSI). The second signal will be a rebound from the upper boundary of the bearish Wedge pattern. Cancellation of the GBP/USD pair fall option in the current trading week July 3 — 7, 2023 will be a strong growth in quotes and a breakdown of the 1.3165 area. This will indicate a breakdown of the resistance area and continued growth to the area above the level of 1.3455. The fall of the GBP/USD currency will be confirmed by a breakdown of the support area and closing of the price below the level of 1.2265, which will indicate a breakdown of the lower border of the “Wedge” reversal pattern.

Among the important news from the UK that may have an impact on the Pound/Dollar rate, it is worth highlighting: Speech by Bank of England (BoE) Governor Bailey Speech.

GBP/USD Weekly Forecast July 3 — 7, 2023 suggests an attempt to rise and test the resistance level near the area of 1.2945. Where should we expect the currency pair to continue falling with the target below the area of 1.1615. An additional signal in favor of the decline will be a test of the trend line on the relative strength index (RSI). Cancellation of the fall option for the Pound/Dollar pair will be a strong growth and a breakdown of the level of 1.3165. In this case, we should expect the pair to continue to rise with a potential target above the level of 1.3455.

Looking for the Best Forex Broker? We trade at RoboForex. You can receive a rebates from each trade when registering using our partner link