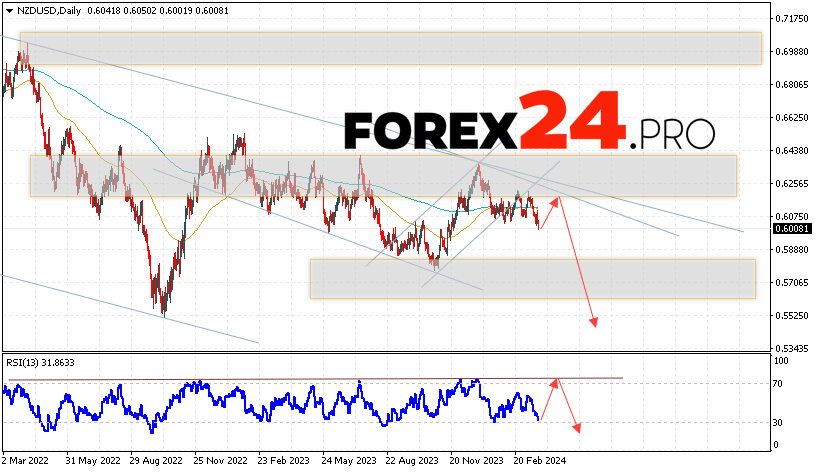

Quotes of the currency pair New Zealand Dollar are finishing the trading week as part of the development of a strong fall near the level of 0.6008. Moving averages indicate a bearish trend for the pair. Prices have broken through the area between the signal lines downwards, which indicates pressure from sellers of the currency pair and a potential continuation of the decline from current levels in the market. At the moment, we should expect an attempt to develop a bullish correction of the currency pair on Forex and a test of the resistance area near the level of 0.6145. Then, a rebound downwards and a continuation of the fall of the currency pair with a potential target below the level of 0.5535.

NZD/USD Forecast March 25 — 29, 2024

An additional signal in favor of a decline in the NZD/USD currency pair will be a test of the downward trend line on the relative strength index (RSI). The second signal will be a rebound from the upper border of the bearish channel. Cancellation of the option of falling pair quotes in the current trading week of March 25 — 29, 2024 will be a strong growth and a breakdown of the 0.6445 area. This will indicate a breakdown of the resistance area and continued growth of the NZD/USD pair with a potential target above the level of 0.6785. Confirmation of the fall of the currency pair on Forex will be a breakdown of the support area and closing of quotes below the 0.5945 area.

NZD/USD Forecast March 25 — 29, 2024 suggests an attempt to develop a bullish correction and test the resistance level near the 0.6145 area. Further, the NZD/USD pair will continue to fall to the area below the level of 0.5535. An additional signal in favor of a decline will be a test of the trend line on the relative strength index (RSI). Cancellation of the option for the pair to fall will be a strong growth and closing of NZD/USD quotes above the level of 0.6445. In this case, we should expect continued growth of the currency pair with a target above the level of 0.6785.

Looking for the Best Forex Broker? We trade at RoboForex. You can receive a rebates from each trade when registering using our partner link