The Swiss franc strengthened above the 0.9 mark, approaching a two-year high of 0.88 hit on May 3rd. This growth occurred against the backdrop of frequent signals about a possible rate hike from the Swiss National Bank. Although evidence points to a slowdown in inflation in the Swiss economy, fears about the risks associated with higher base prices led the head of the Swiss National Bank, Thomas Jordan, to note a possible rate hike next week. Moreover, demand deposits at the Swiss National Bank fell below CHF 510 billion in June, the lowest since 2016. This indicates that the central bank is reducing the availability of liquidity in the Swiss economy and is set to increase the cost of borrowing. Swiss consumer prices rose 2.2% y/y in May, the lowest in 15 months and well below the central bank’s expectations.

USD/CHF Weekly Forecast June 19 — 23, 2023

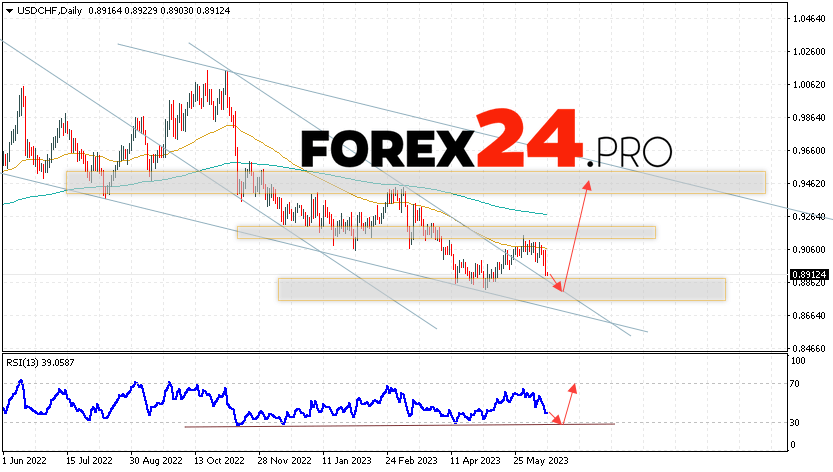

Currency pair Dollar Franc USD/CHF completes the trading week near the level of 0.8912. The pair continues to move within the correction and the downward channel. Moving averages indicate a bearish trend. Prices went down from the area between the signal lines, which indicates pressure from sellers of the US currency and a potential continuation of the fall of the instrument from current levels. At the moment, we should expect an attempt to develop a price decrease and test the support area near the level of 0.8845. Further, a rebound upwards and an attempt to continue the growth of the pair with a potential target above the level of 0.9465.

An additional signal in favor of the rise of the Dollar Franc currency pair will be a test of the trend line on the relative strength index (RSI). The second signal will be a rebound from the upper border of the descending channel. Cancellation of the USD/CHF growth option will be a fall and a breakdown of the 0.8655 area. This will indicate a breakdown of the support area and a continuation of the fall of the pair on Forex with a target below the 0.8335 area. The growth of the pair in the current trading week June 19 — 23, 2023 will be confirmed by a breakdown of the resistance area and closing of quotes above the level of 0.9095.

Among the important news from Switzerland that may have an impact on the Swiss Franc against the US Dollar, it is worth highlighting: Swiss National Bank (SNB) Interest Rate Decision, Swiss National Bank (SNB) News Conference.

USD/CHF Weekly Forecast June 19 — 23, 2023 suggests an attempt to continue the development of the correction and test the support level near the area of 0.8845. Then, the continuation of the growth of USD/CHF to the area above the level of 0.9465. In favor of the rise will be a test of the trend line on the relative strength index (RSI). Cancellation of the USD/CHF growth option will be a breakdown of the support area and closing of quotes below the level of 0.8655. This will indicate a continued decline in the pair with a potential target below the level of 0.8335.