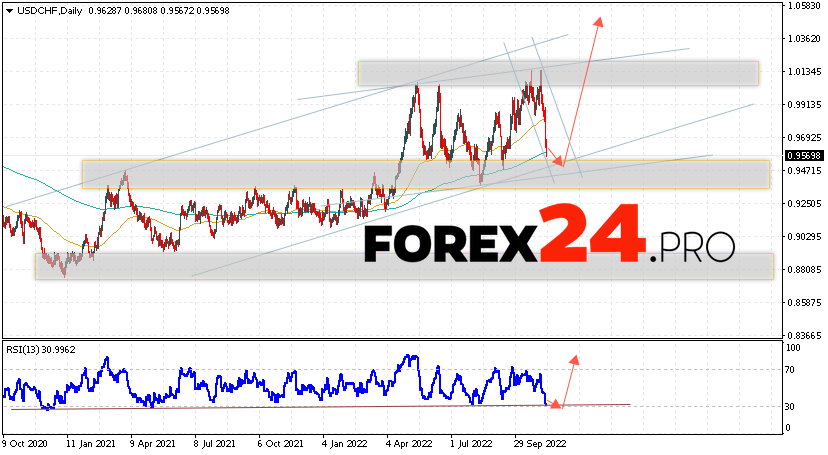

Currency pair USD/CHF Dollar/Franc completes the trading week near the level of 0.9568. The pair continues to move within the correction and a long-term bullish channel. Moving averages indicate a bullish trend. Prices have broken through the area between the signal lines up, which indicates pressure from buyers of the US currency and a potential continuation of the growth of the instrument from current levels. At the moment, we should expect an attempt to develop a downward price correction and a test of the support area near the level of 0.9485. Further, a rebound and an attempt to continue the rise of the pair with a potential target above the level of 1.0425.

USD/CHF Weekly Forecast November 14 — 18, 2022

An additional signal in favor of the rise of the Dollar Franc currency pair will be a test of the trend line on the relative strength index (RSI). The second signal will be a rebound from the lower border of the bullish channel. Cancellation of the USD/CHF rise option will be a fall and a breakdown of the 0.9245 area. This will indicate a breakdown of the support area and a continuation of the fall of the pair on Forex with a target below the 0.8765 area. The rise of the pair in the current trading week November 14 — 18, 2022 will be confirmed by a breakdown of the resistance area and closing of quotes above the level of 0.9745, which will indicate a breakdown of the upper limit of the downward correction channel.

USD/CHF Weekly Forecast November 14 — 18, 2022 suggests an attempt to continue the development of the correction and test the support level near the 0.9485 area. Then, the continuation of the growth of USD/CHF to the area above the level of 1.0425. In favor of the rise will be a test of the trend line on the relative strength index (RSI). Cancellation of the USD/CHF growth option will be a breakdown of the support area and closing of quotes below the level of 0.9245. This will indicate a continuation of the fall of the pair with a potential target below the level of 0.8765.