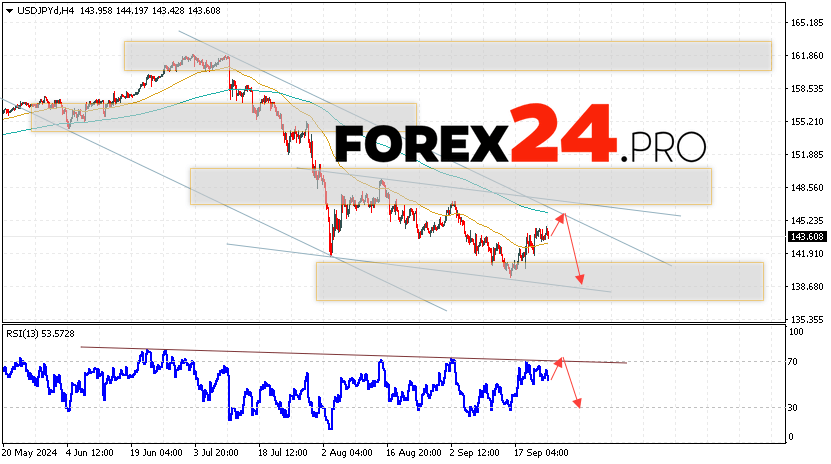

The quotes of the USD/JPY currency pair continue to move within the development of growth and a descending channel. At the time of publication of the forecast, the US Dollar to Japanese Yen exchange rate is 143.60. Moving averages indicate the presence of a short-term bullish trend for the pair. Prices are again testing the area between the signal lines, which indicates pressure from sellers of the US Dollar and a potential continuation of the fall in prices from the current levels. As part of the forecast of the Japanese Yen exchange rate for September 26, 2024, we should expect an attempt to develop a bullish price correction and a test of the resistance area near the level of 145.25. Then, a downward price rebound and a continuation of the fall of the USD/JPY pair to the area below the level of 138.65.

USD/JPY Forecast Japanese Yen for September 26, 2024

An additional signal in favor of a decline in the USD/JPY currency pair will be a test of the resistance line on the relative strength indicator. The second signal will be a rebound from the upper border of the descending channel. The cancellation of the fall option for the Dollar Yen currency pair will be a strong growth and a breakout of the 148.85 level. This will indicate a breakout of the resistance area and continued growth of the Dollar Yen currency pair. In this case, we should expect the pair to continue to rise to the area above the 152.55 level. We should expect confirmation of the price fall with a breakout of the support level and consolidation of the price below the 141.85 area.

USD/JPY Forecast Japanese Yen for September 26, 2024 suggests an attempt to test the resistance area near the 145.25 level. Then, a continuation of the fall in quotes to the area below the 138.65 level. A test of the trend line on the relative strength indicator will be in favor of the decline of the pair. The cancellation of the fall option will be a strong growth and a breakout of the 148.85 area. This will indicate a breakout of the resistance level and continued growth in the pair with a potential target above the level of 152.55.