The Japanese yen has consolidated above 144 dollars per US dollar for the first time since the beginning of November. The pair approached the key level of 145 as close as possible, which prompted the Japanese authorities to intervene in September and October last year. Senior country officials have already begun to warn of a sharp fall in the yen, saying they are watching the market closely and will react accordingly if moves become overly aggressive. The yen weakened after Bank of Japan Governor Kazuo Ueda reiterated that “there is still a long way to go” to reach 2% inflation sustainably with sufficient wage growth. This is in stark contrast to other major central banks as the Federal Reserve, the European Central Bank and the Bank of England signal further rate hikes this year. Meanwhile, the latest data showed that inflation in Tokyo exceeded the Bank of Japan’s 2% target for the 13th consecutive month in June amid rising inflationary pressures.

USD/JPY Weekly Forecast July 3 — 7, 2023

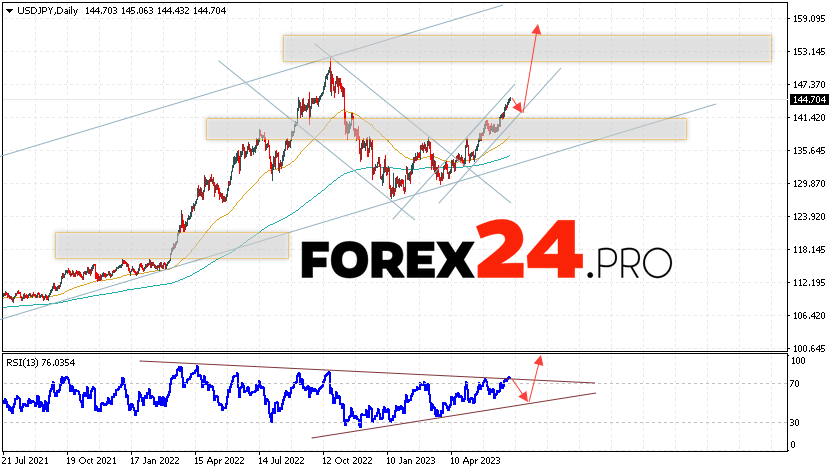

Quotes of the currency pair Dollar to Yen USD/JPY complete the trading week with growth near the area of 144.70. The pair continues to move as part of the rise and the bullish channel. Moving averages indicate a bullish trend. Prices have broken through the area between the signal lines up, which indicates pressure from buyers of the US dollar and a potential continuation of growth already from current levels. At the moment, we should expect an attempt to develop a price reduction and a test of the support level near the area of 143.65. Then, a rebound up and the continuation of the growth of the pair to the area above the level of 156.85.

An additional signal in favor of the rise of the Dollar/Yen pair in the current trading week will be a test of the trend line on the relative strength index (RSI). The second signal will be a rebound from the lower border of the bullish channel. Cancellation of the growth option for the USD/JPY pair in the current trading week July 3 — 7, 2023 will be a fall and a breakdown of the 140.05 area. This option will indicate a breakdown of the support area and a continuation of the fall of the pair on Forex to the area below the level of 136.75. The USD/JPY growth will be confirmed by the breakdown of the resistance area and the closing of the price above the level of 147.95.

Among the important news from Japan that may have an impact on the Japanese Yen, it is worth highlighting: Bank of Japan (BoJ) Tankan Large Manufacturing Index, Bank of Japan of Japan (BoJ) Tankan Large Non-Manufacturing Index.

USD/JPY Weekly Forecast July 3 — 7, 2023 suggests an attempt to test the support level near the area of 143.65. Where should we expect the pair to continue rising to the area above the level of 156.85. An additional signal in favor of growth will be a test of the trend line on the relative strength index (RSI). Cancellation of the pair’s rise option will be a fall and a breakdown of the level of 140.05. This will indicate a continued decline in the pair with a potential target below the 136.75 area.

Looking for the Best Forex Broker? We trade at RoboForex. You can receive a rebates from each trade when registering using our partner link