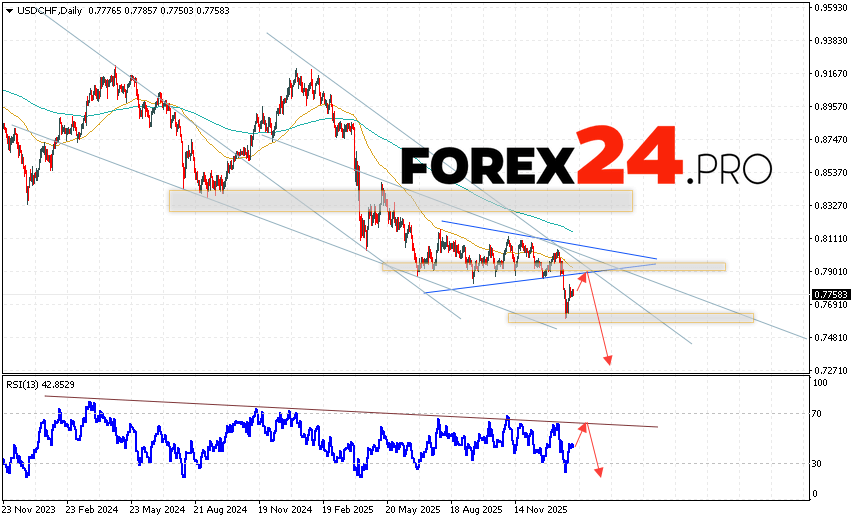

The USD/CHF Dollar/Charcoal Franc currency pair is ending the trading week with a decline near 0.7758. The pair continues to move as part of a downward trend and the beginning of a “Triangle” pattern. Moving averages indicate a bearish trend. Prices have broken below the area between the signal lines, indicating downward pressure from sellers of the US currency and a potential continuation of the instrument’s decline from current levels. At this point, we should expect an attempt to develop a bullish price correction and a test of the resistance area near 0.7875. Subsequently, a downward rebound and an attempt to continue the decline of the currency pair with a potential target below 0.7285.

USDCHF Weekly Forecast February 9 – 13, 2026

An additional signal favoring a decline in the USD/CHF currency pair will be a test of the resistance line on the relative strength indicator (RSI). A second signal will be a rebound from the lower boundary of the “Triangle” pattern. A strong rally in USD/CHF prices and a breakout of the 0.8225 area would cancel out the USD/CHF downside scenario this week. This would indicate a breakout of the resistance area and continued growth in the Forex market with a target above 0.8535. A breakout of the support area and a close below 0.7505 would confirm a decline in the pair during the current trading week (February 9-13, 2026).

USDCHF Weekly Forecast February 9 – 13, 2026 suggests an attempt to develop a bullish correction and a test of the resistance level near 0.7875. Subsequently, the USD/CHF pair will continue to decline below 0.7285. A test of the trend line on the relative strength indicator (RSI) would support a decline. The USD/CHF downside scenario would be cancelled if the pair breaks the resistance area and closes above 0.8225. This would indicate continued upside with a potential target above 0.8535.