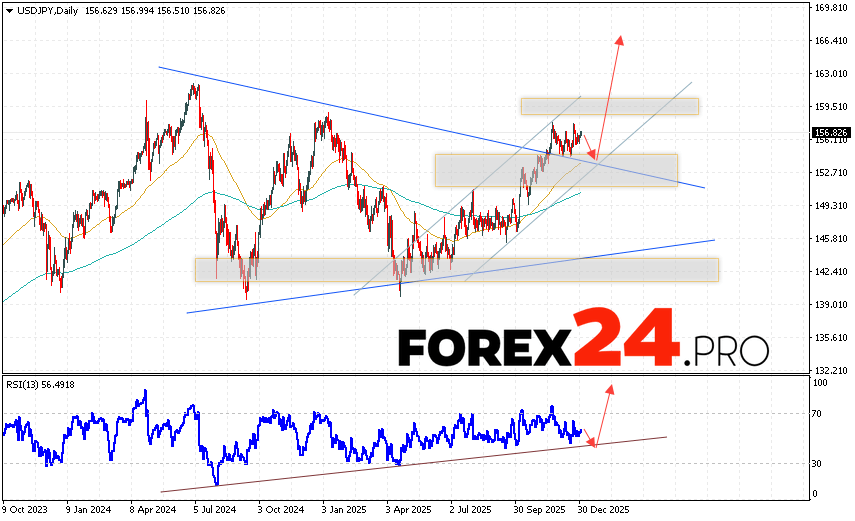

The USD/JPY currency pair is ending the trading week with a correction within a bullish channel near the 156.82 area. Moving averages indicate a bullish trend. Prices have broken above the signal lines, indicating upward pressure from US dollar buyers and potential continued growth from current levels. Currently, we expect an attempt at a bearish price correction and a test of support near the 153.05 area. This should be followed by an upward rebound and continued growth above 166.45.

USD/JPY Weekly Forecast January 5 – 9, 2026

An additional signal in favor of growth for the USD/JPY pair this trading week will be a test of the bullish trend line on the relative strength indicator. The second signal will be a rebound from the lower boundary of the bullish channel. A decline and a breakout of the 151.55 area would cancel out the USD/JPY uptrend during the current trading week (January 5-9, 2026). This would indicate a breakout of the support area and a continued decline in the Forex pair below 148.05. A breakout of the resistance area and a price close above 159.35 would confirm an uptrend in the USD/JPY pair.

USD/JPY Weekly Forecast January 5 – 9, 2026 suggests an attempt at a bearish correction and a test of the support level near 153.05. From there, we should expect continued growth above 166.45. An additional signal in favor of an uptrend would be a test of the trend line on the relative strength indicator. The pair’s growth scenario would be cancelled if it falls and breaks below 151.55. This would indicate continued decline with a potential target below 148.05.