Gold rose above $1960 on Friday and was expected to end the week higher. This was driven by a weaker dollar due to a rise in weekly US jobless claims, fueling expectations that the Federal Reserve (Fed) will put a hold on interest rate hikes next week. Markets now expect the Fed to keep rates unchanged at next week’s meeting before resuming the tightening cycle in July. The European Central Bank and the Bank of Japan are also due to make decisions on monetary policy next week. At the same time, investors are being cautious as the International Monetary Fund has urged major central banks to “keep the course” in their monetary policy and keep a close eye on inflation. The Reserve Bank of Australia and the Bank of Canada unexpectedly raised interest rates this week, increasing the likelihood that other advanced economies will follow suit.

GOLD Weekly Forecast June 12 — 16, 2023

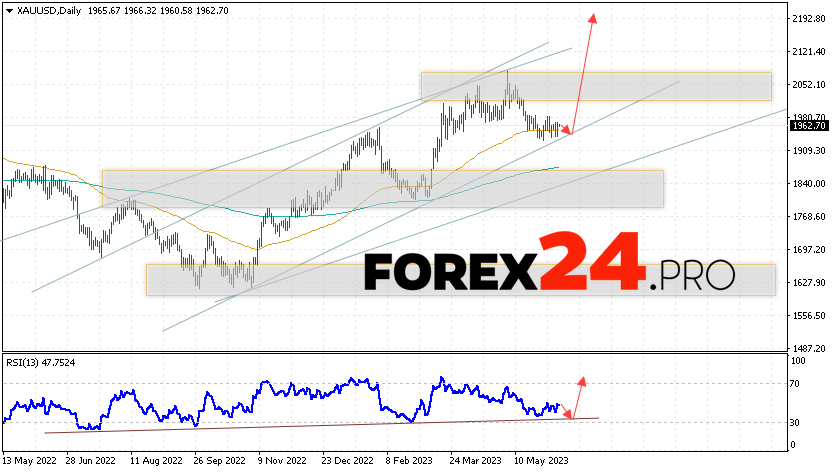

Gold completes the trading week with a correction near the 1962 area. XAU/USD quotes continue to move within a slight increase and a bullish channel. Moving averages indicate the presence of a bullish trend for Gold. Prices have gone up from the area between the signal lines, which indicates pressure from buyers and a potential continuation of price growth. At the moment, we should expect an attempt to develop a decrease in prices and a test of the support level near the 1950 area. Further, a rebound in prices and continued growth of Gold with a potential target above the level of 2195.

An additional signal in favor of the rise in quotes and prices for Gold in the current trading week of June 12 — 16, 202 will be a rebound from the support line on the relative strength index (RSI). The second signal will be a rebound from the lower border of the bullish channel. Cancellation of the growth option for XAU/USD quotes will be a fall in prices and a breakdown of the 1905 area. This will indicate a breakdown of the support level and a continued fall in Gold prices with a target below the level of 1865. A confirmation of the growth in the value of the asset will be a breakdown of the resistance area and closing of quotes above the level of 2015.

GOLD Weekly Forecast June 12 — 16, 2023 suggests an attempt to develop a decline and test the support level near the 1950 area. Then, the continued growth in Gold prices with a target above the level of 2195. A test of the trend line on the relative strength index (RSI) will come out in favor of the rise in quotes. Cancellation of the growth option for GOLD will be a fall and a breakdown of the level of 1905. This will indicate a continued decline in quotes to the area below the level of 1865.

Looking for the Best Forex Broker? We trade at RoboForex. You can receive a rebates from each trade when registering using our partner link