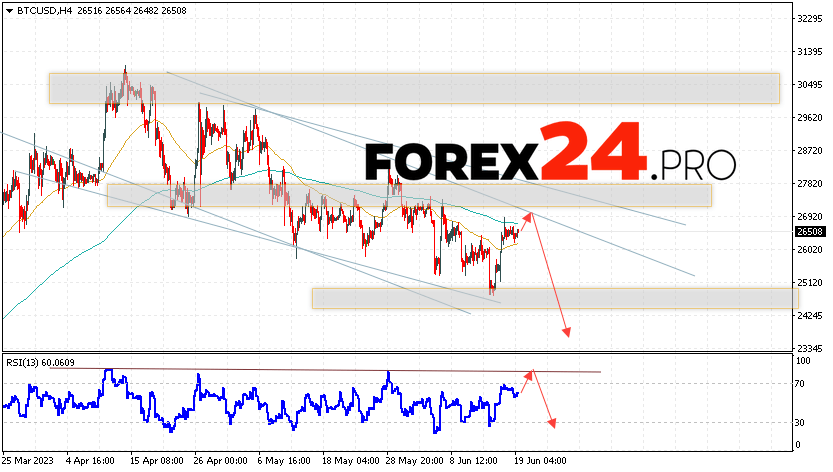

The BTC/USD quotes are trading at the level of 26,508 and continue to move within a downtrend and a bearish channel. The market capitalization of Bitcoin at the time of this forecast publication is $513,374,184,522. The moving averages indicate the presence of a short-term bearish trend for Bitcoin. Prices are once again testing the area between the signal lines to the downside, indicating selling pressure on the “Digital Gold” and the potential continuation of the asset’s decline from current levels. As part of the cryptocurrency forecast for tomorrow, June 21, 2023, we should expect an attempt to develop a bullish correction in the price of the digital asset and test the resistance level near the area of 26,965. From there, we can expect a rebound downwards and an attempt to continue the decline in the Bitcoin exchange rate with a target below the area of 23,605.

Bitcoin Forecast for June 21, 2023

An additional signal in favor of a decrease in BTC/USD quotes would be a test of the trend line on the Relative Strength Index indicator. A second signal in favor of this scenario would be a rebound from the upper boundary of the bearish channel. The scenario of the coin’s and Bitcoin’s price decline would be invalidated by a strong increase in the asset’s value and a breakthrough of the 27,565 area. This would indicate a breakout of the resistance area and the continuation of the Bitcoin exchange rate’s rise with a potential target at the 29,865 level. Confirmation of the price decline would be a breakthrough of the support area and the price closing below the 25,405 level.

Bitcoin Forecast for June 21, 2023 suggests an attempt to test the resistance level near the area of 26,965. And then, a continuation of the cryptocurrency’s decline with a potential target at the 23,605 level. An additional signal in favor of a decrease in the Bitcoin exchange rate would be a test of the resistance line on the Relative Strength Index indicator. The scenario of the digital currency’s decline would be invalidated by a breakthrough of the 27,565 area. This would indicate a continuation of the coin’s rise with a potential target above the 29,865 area.

Looking for the Best Forex Broker? We trade at RoboForex. You can receive a rebates from each trade when registering using our partner link