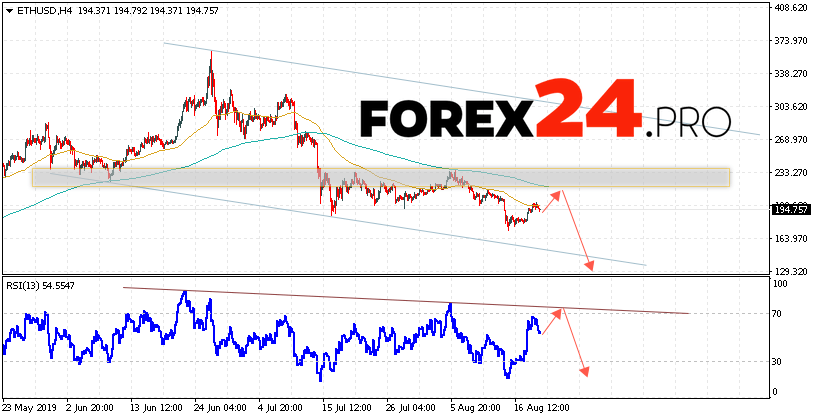

Ethereum are trading at 194.75 and continue to move as part of the correction and the downward channel. Cryptocurrency capitalization at the time of the publication of the forecast is $21 185 368 374. Moving averages indicate the presence of a short-term bearish trend for Ethereum. At the moment, we should expect an attempt to grow and test the resistance level near the area of 210.00. Where again we should expect a rebound and the continuation of the Ethereum rate drop with a potential target below 130.00.

Ethereum Forecast and ETHUSD Analysis August 21, 2019

An additional signal in favor of falling ETH/USD quotes will be a test of a downward trend line on the relative strength index (RSI). The second signal will be a rebound from the area of moving averages. Cancellation of the option of falling cryptocurrency will be a strong growth and a breakdown of the level of 245.00. This will indicate a breakdown of the resistance area and continued growth of the ETH/USD quotes above the level of 285.00. With the breakdown of the support area and closing of quotes below 165.00, we can expect acceleration of the development of a downward trend in Ethereum.

Ethereum Forecast and ETHUSD Analysis August 21, 2019 implies an attempt to test the resistance area near the level of 210.00. Where can we expect a rebound and the continuation of the fall of the ETH/USD cryptocurrency to the area below the level of 130.00. An additional signal in favor of Ethereum’s fall will be a test of the trend line on the relative strength index (RSI). The cancellation of the option to reduce the digital currency will be the breakdown of the 245.00 area. Which will indicate the continuation of the rise with a potential target above the level of 285.00.

Looking for the Best Forex Broker? We trade at RoboForex. You can receive a rebates from each trade when registering using our partner link