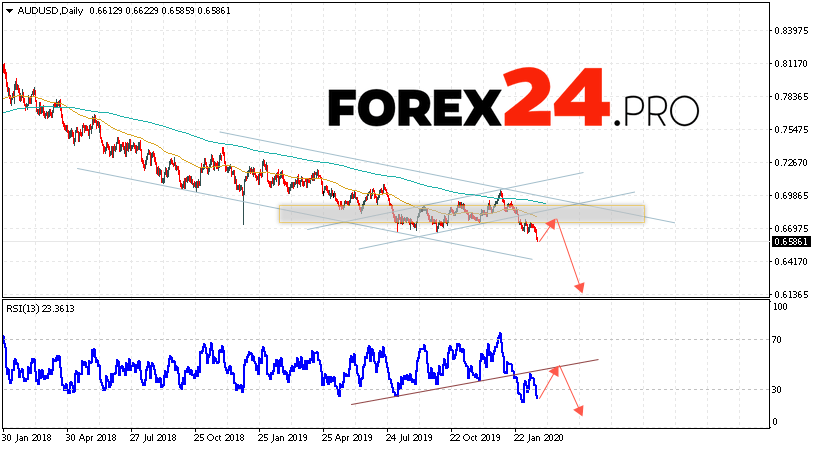

Currency pair Australian Dollar to US Dollar AUD/USD completes the trading week near the area of 0.6586. The pair continues to move within the fall and the downward channel. Moving averages indicate a bearish trend. Prices pushed from the area between the signal lines, indicating pressure from sellers. At the moment, we should expect an attempt to develop an upward correction and test the resistance area near the level of 0.6715. Then, the continuation of the fall of AUD/USD with a potential target below the level of 0.6145.

AUD/USD Forecast and Analysis February 24 — 28, 2020

A test of the resistance line on the relative strength index (RSI) will be in favor of the fall of the pair on Forex. The second signal will be a rebound rebound from the upper boundary of the downward channel. Cancellation of the option to reduce AUD/USD in the current trading week February 24 — 28, 2020 will be a strong growth and the breakdown level of 0.7035. This will indicate a breakdown of the upper boundary of the channel and continued growth of the Australian Dollar at Forex. The development of the downtrend will be confirmed by the breakdown of the support area and closing below 0.6515.

Important news from Australia that could have an impact on the Australian exchange rate is not expected, so the pair will continue to move as part of a technical analysis.

AUD/USD Forecast and Analysis February 24 — 28, 2020 suggests an attempt to test the level of 0.6715. Further, the continuation of the fall below the level of 0.6145. In favor of reducing the pair, a test of the downward trend line on the relative strength index (RSI) will come out. Cancellation of the fall option will be a strong growth and a breakdown of the 0.7035 area. This will indicate a breakdown of the resistance area and continued growth of the pair with a target above 0.7305.

Looking for the Best Forex Broker? We trade at RoboForex. You can receive a rebates from each trade when registering using our partner link