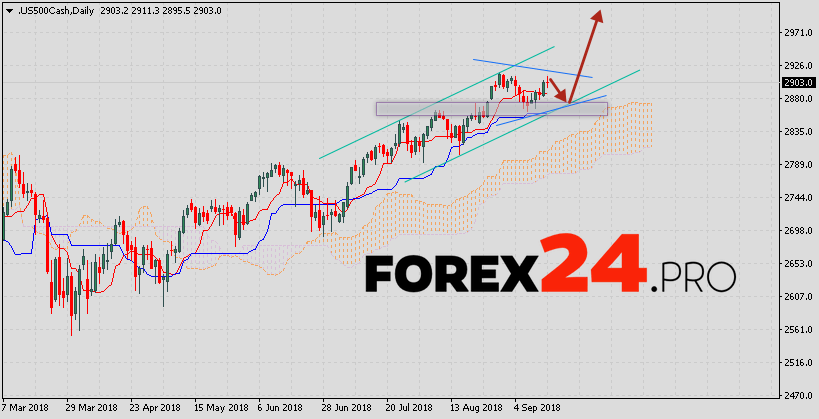

The stock index S&P 500 completes the trading week near the level of 2903. The index is traded above the upper boundary of the Cloud Ichimoku Kinko Hyo, which indicates the presence of an upward trend. As part of the S&P 500 weekly forecast & analysis September 17 — 21, 2018, the Ichimoku Kinko Hyo signal line area test is expected near the level of 2855, from which it is expected to attempt a rebound and continue the development of the bullish trend with a view to growth near the level of 2995.

S&P 500 weekly forecast & analysis September 17 — 21, 2018

An additional signal in favor of the growth of quotations of the index on the current trading week on September 17 — 21, 2018 will be a test of the support area, as well as a rebound from the lower boundary of the bullish channel. Previously, a strong signal was received for the S&P 500 stock index purchases, due to crossing of the signal lines at the level of 2745.

Cancellation of the variant of growth of quotations of the stock index will be a breakdown of the lower boundary of the Cloud of Ichimoku Kinko Hyo with the closing of quotes below the area of 2770, which will indicate a change in the bullish trend in favor of the bearish trend and the continuation of the fall. Expect to accelerate the growth of quotations of the stock exchange index S&P 500 is with the breakdown of the upper limit of the model «Triangle» and the closing above the level of 2925.

S&P 500 weekly forecast & analysis September 17 — 21, 2018 presupposes a test of the level of the support level near the area of 2855, from which it is expected to rebound and continue the growth of quotations of the index with a potential target near the level of 2995, the cancellation of the growth of quotations will make a strong fall and the breakdown of the region 2770, which indicates the continued decline in the S&P 500.

Looking for the Best Forex Broker? We trade at RoboForex. You can receive a rebates from each trade when registering using our partner link