Want to know the current price of FedEx and what’s next for FDX stock? On this page, we share the latest FedEx news and advice on buying stocks. You can also view the latest FedEx Forecast for 2022 and 2023 from our experts.

Should You Buy or Sell FedEx Stock Today? To what levels can the shares of this company rise in a year, two, three? How much will FedEx papers cost in 2021, 2022, 2023? We have been making currency rate forecasts for a long time, and we can also predict the behavior of the stock market using technical analysis and simple indicators.

We also take into account the technical, fundamental analysis of stocks, the news background, the general geopolitical situation in the world and other, smaller factors. The stock forecasts indicate target levels for FDX shares, both up and likely down.

FedEx Forecast for 2022 and 2023

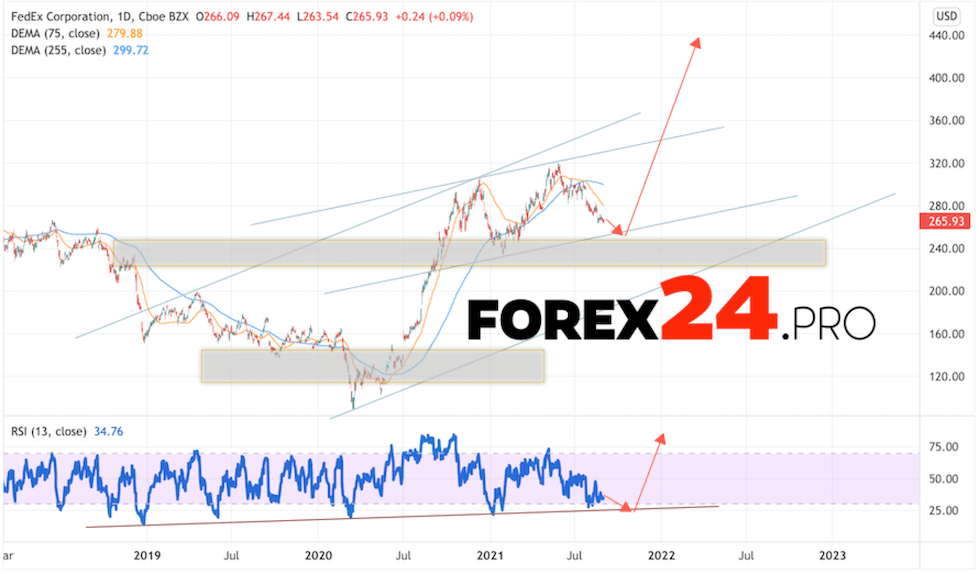

FedEx quotes continue to move within the correction and the bullish channel. The moving averages point to a short-term bearish trend in FDX stock. Prices have gone down from the area between the signal lines, which indicates pressure from sellers of securities and a likely continuation of the fall in the near future. At the time of publication of the forecast, the cost of FedEx shares is 265.93 per share. As part of the forecast, we should expect an attempt to develop a small correction and a test of the support level near the area of 250.05. Further, the price bounces up and the continued rise in the value of securities. The potential target of such a movement in shares is the area above the level of 440.05 already in 2021, 2022, 2023.

An additional signal in favor of the growth of FedEx quotes will be a test of the trend line on the relative strength index (RSI). The second signal will be a rebound from the lower border of the rising channel. Cancellation of the option to raise the price of FedEx shares will be a fall and a breakdown of the level of 230.55. This will indicate a breakdown of the support area, in which case we can consider the continuation of the decline in securities to the area at the level of 160.55. It is worth waiting for confirmation of the rise in shares with a breakdown of the resistance area and closing above the level of 335.05, which will indicate a breakdown of the upper limit of the bullish channel.

FedEx Forecast for 2022 and 2023 suggests an attempt to develop a decline and test the support area near the level of 250.05. Where should we expect a rebound and an attempt to continue the rise of shares in the area above the level of 440.05. In favor of the growth of securities, a test of the trend line on the relative strength index (RSI) will come out. Cancellation of the FDX rise option will be a fall and a breakdown of the level of 230.55. This will indicate a breakdown of the lower border of the channel and a continuation of the fall in value to the area below the level of 160.55.

Looking for the Best Forex Broker? We trade at RoboForex. You can receive a rebates from each trade when registering using our partner link