The British Pound continues to rise against the US Dollar, reaching above 1.27 USD, the highest level since April 2022. The latest economic data has pushed traders to raise their expectations about the number of rate hikes coming from the Bank of England as part of its tightening cycle.

According to the monthly GDP report, the UK economy grew by 0.2% in April thanks to a significant contribution from the retail trade and the film industry. Higher-than-expected inflation and employment put pressure on the Bank of England to consider further rate hikes in response to sustained price pressures. Despite inflation falling to 8.7% in April, it remains well above the bank’s target of 2%, while wage growth accelerated to 7.2% and the labor market remains tight.

Investors are now forecasting that the UK benchmark interest rate will peak at 5.00% by the end of August, exceeding forecasts of 4.50% in May.

GBP/USD Weekly Forecast June 19 — 23, 2023

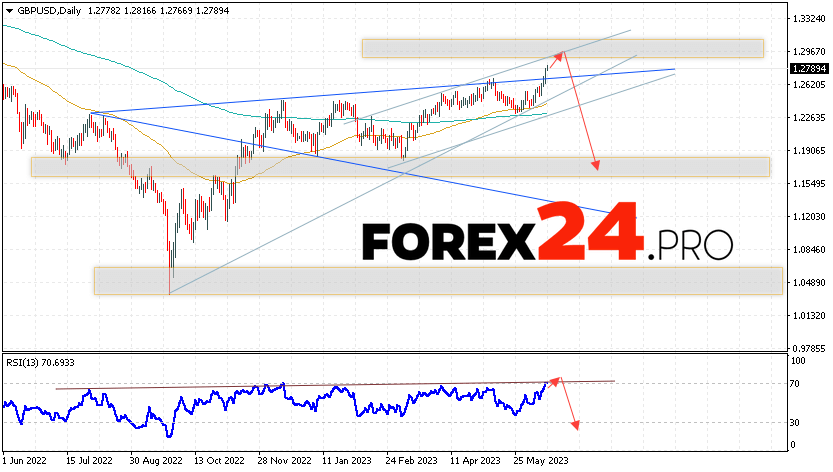

The currency pair Pound/Dollar GBP/USD completes the trading week as part of the development of an aggressive rise and the continuation of the formation of the bearish Wolfe Wave model with a target at the level of 1.1205. Moving averages indicate a bullish trend. Prices have broken through the area between the signal lines up, which indicates pressure from buyers and a potential continuation of the growth of the British Pound against the US Dollar already from current levels. At this point, we should expect an attempt to develop a rise and test the resistance area near the level of 1.2975. Further, a rebound down and the continuation of the fall of the Pound Dollar quotes to the area below the level of 1.1865.

An additional signal in favor of the decline of the British Pound will be a test of the resistance line on the relative strength index (RSI). The second signal will be a rebound from the upper border of the bearish “Wolfe Wave” pattern. Cancellation of the option to fall the GBP/USD pair in the current trading week June 19 — 23, 2023 will be a strong growth in quotes and a breakdown of the 1.3105 area. This will indicate a breakdown of the resistance area and continued growth to the area above the level of 1.3435. The fall of the GBP/USD currency will be confirmed by a breakdown of the support area and closing of the price below the level of 1.2235.

Among the important news from the UK that may have an impact on the Pound/Dollar rate, it is worth highlighting: Bank of England (BoE) Interest Rate Decision.

GBP/USD Weekly Forecast June 19 — 23, 2023 suggests an attempt to rise and test the resistance level near the area of 1.2975. Where should we expect the currency pair to continue falling with the target below the area of 1.1865. An additional signal in favor of the decline will be a test of the trend line on the relative strength index (RSI). Cancellation of the fall option for the Pound/Dollar pair will be a strong growth and a breakdown of the level of 1.3105. In this case, we should expect the pair to continue to rise with a potential target above the level of 1.3435.

Looking for the Best Forex Broker? We trade at RoboForex. You can receive a rebates from each trade when registering using our partner link