The Japanese yen remained near 139 per dollar, approaching a six-month low of 140, which was tested by buyers in May this year. At the same time, the Bank of Japan maintained its policy of minimum interest rates, despite market pressure and stable inflation. At the same time, major central banks continued to pursue tight monetary policy. Unexpectedly, the Bank of Canada and the Reserve Bank of Australia raised interest rates, raising expectations that the Federal Reserve will make another rate hike in July. The latest data also showed that the Japanese economy grew much more than expected in the first quarter.

USD/JPY Weekly Forecast June 12 — 16, 2023

In the first quarter of 2023, the Japanese economy posted an annual growth rate of 2.7%, an improvement from the provisional growth rate of 1.6% and upwardly revised growth of 0.4% in the previous period. This result exceeded the expectations of the market, which expected growth of only 1.9%. The acceleration of private consumption after the lifting of all measures related to the pandemic has become one of the factors contributing to growth. Business has also recovered strongly and government spending has continued to rise. However, net exports had a negative impact due to uncertainty in world trade.

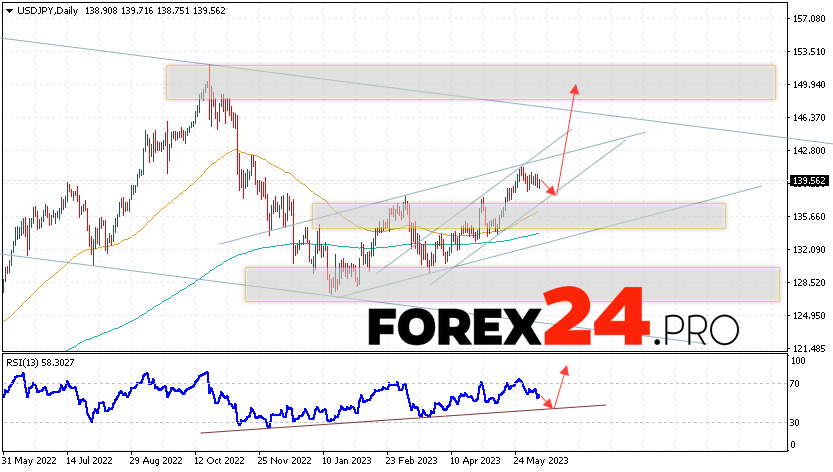

Quotes of the currency pair Dollar to Yen USD/JPY complete the trading week with a correction near the area of 139.56. The pair continues to move within a slight decline and a bullish channel. Moving averages indicate a bullish trend. Prices have broken through the area between the signal lines up, which indicates pressure from buyers of the US dollar and a potential continuation of growth already from current levels. At the moment, we should expect an attempt to develop a price reduction and a test of the support level near the area of 138.65. Then, a rebound up and the continuation of the growth of the pair to the area above the level of 149.75.

An additional signal in favor of the rise of the Dollar/Yen pair in the current trading week will be a test of the trend line on the relative strength index (RSI). The second signal will be a rebound from the lower border of the bullish channel. Cancellation of the growth option for the USD/JPY pair in the current trading week June 12 — 16, 2023 will be a fall and a breakdown of the 135.65 area. This option will indicate a breakdown of the support area and the continued fall of the pair on Forex to the area below the level of 132.45. The USD/JPY growth will be confirmed by the breakdown of the resistance area and the closing of the price above the level of 142.85, which will indicate the breakdown of the upper limit of the bullish channel, and this is a signal to increase the width of the channel.

USD/JPY Weekly Forecast June 12 — 16, 2023 suggests an attempt to test the support level near the area of 138.65. Where should we expect the pair to continue rising to the area above the level of 149.75. An additional signal in favor of growth will be a test of the trend line on the relative strength index (RSI). Cancellation of the pair’s rise option will be a fall and a breakdown of the level of 135.65. This will indicate a continued decline in the pair with a potential target below the 132.45 area.

Looking for the Best Forex Broker? We trade at RoboForex. You can receive a rebates from each trade when registering using our partner link